Rudolph Technologies (RTEC) once again topped Wall Street’s expectations, which caused analysts to raise estimates that are now approaching pre-recession levels.

Company Description

Rudolph Tech makes tools for semiconductor makers for defect inspection, process control metrology and data analysis. The company is based in the U.S. but operates worldwide.

EPS Doubles Estimate

On Aug 2 Rudolph Tech reported quarterly results that showed a 19% sequential increase in revenue, to $48.3 million. Combined with improving margins, this lead to earnings per share of 23 cents, more than twice the 11 cents that was expected.

Comments from the CEO surrounded the successful business implementations that have allowed them to avoid the volatility of the semiconductor industry and should lead to a 6-10% revenue boost next quarter.

Estimates Pop

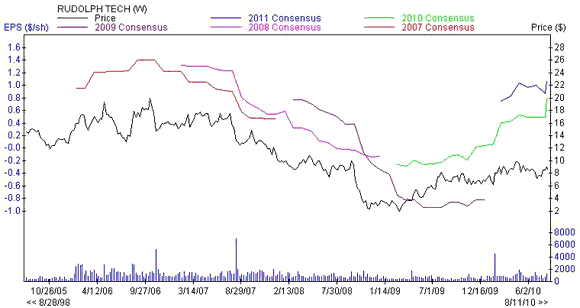

Analysts liked the results and the commentary from the company and immediately and drastically raised earnings estimates.

The Zacks Consensus Estimate for this year jumped 31 cents, to 80 cents. Next year’s forecasts rose 21 cents to $1.08. In 2009 Rudolph Tech posted a 56 cent loss. Even with the aggressive expectations, the company has topped estimates in each quarter for the past 2 years.

Expanding

Earlier this week Rudolph Tech announced that they acquired some assets from MKS Instruments. The purchase included intellectual property, unspecified assets and 35 employees to join the Data Analysts and Review Business Unit.

The Chart

Expectations for Rudolph Tech have bounce back sharply and are nearing pre-recession levels. The sharp year-over-year increases also leaves shares trading at great valuations. RTEC has a forward P/E under 11 times and a PEG ratio of 0.4.

Leave a Reply