Nalco Holding Company (NLC) helps its customers reduce energy, water and other natural resource consumption, enhance air quality, minimize environmental releases, and improve productivity, while boosting the bottom line.

Business

Nalco is the world’s leading water treatment and process improvement company, delivering significant environmental, social and economic performance benefits to its customers.

Growth and Income

The company is expected to grow its earnings per share 82.5% in 2010, 15.1% in 2011, and 17.5% over the long term. Its trailing 12-month return on equity is 34.9%. The stock also offers investors a small dividend yield of 0.6%.

This Zacks #2 Rank stock trades at 16x 2010 consensus EPS estimates and 14x 2011 consensus EPS estimates.

Recent News

On July 27, Nalco announced second-quarter revenue of $1.1 billion, up 19% year-over-year. The company had EPS of $0.41, beating the Zacks Consensus by 7 cents, or 20.6%.

In the last two quarters, Nalco has beaten the Zacks Consensus Estimate by 24.9%

Chairman and CEO Erik Fyrwald said, “We are growing in every region with our leading technology, commitment to service excellence and responsiveness to customer needs. While putting substantial effort into the 2 percent of sales this year from Gulf spill dispersants, we remained focused on driving execution excellence across our core businesses — helping industry save water, improve energy efficiency, reduce emissions, increase productivity and turn out better quality products.”

Estimates

In the last month, the Zacks Consensus Estimate for 2010 has increased 8 cents, or 6.3%, to $1.49. The Zacks Consensus Estimate for 2011 has climbed 2 cents, or 1.2%, to $1.72.

For the second half of 2010, the company expects sales growth in the mid-single digits and adjusted EPS of more than $1.40.

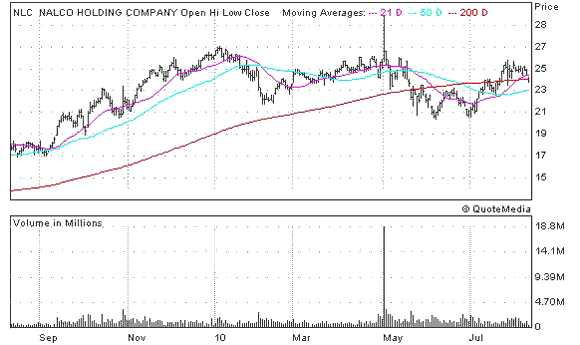

The Chart

NLC shares are up over 33% in the last twelve months. However, the stock has been in a trading range since November 2009. The high end of the range is $27 and the low end is $20, where NLC appears to have decent support. A break above $27 would be positive for the stock, and a break below $20 would be negative.

Leave a Reply