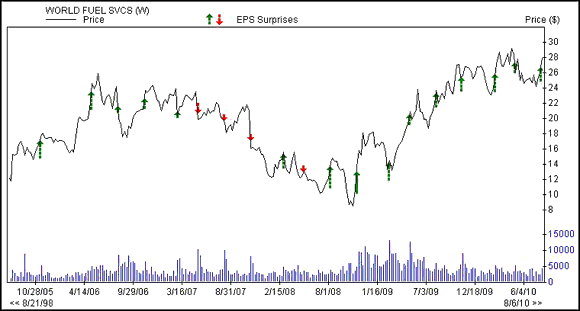

World Fuel Services Corporation (INT) recently continued its earnings hot streak when it beat the Zacks Consensus Estimate for an impressive 9th time in a row.

World Fuel Services sells marine, aviation and land fuel products to clients at more than 6,000 locations in 200 countries. Customers include airports, seaports, tanker truck loading terminals and other storage locations.

Record Volume in the Aviation Segment

On Aug 3, World Fuel Services reported its second quarter results which saw record gross profit in its aviation segment. Profit rose 33% to $52.9 million from $13.1 million in the year ago period. Profit also rose 9% sequentially in that segment.

The marine segment also saw gross profit rise 7% to $43.2 million from the second quarter of 2009. It was the highest quarterly gross profit by the marine segment since the first quarter of 2009.

Only the land segment was flat year over year, although it did show 4% sequential growth.

The company surprised on the Zacks Consensus Estimate by 23.5%. Earnings per share were 63 cents compared to the Zacks Consensus of 51 cents. It made 46 cents in the year ago quarter.

You can see the great earnings surprise history in this 5-year chart below.

Estimates Revised Higher for 2010 and 2011

World Fuel Services did not provide any guidance on earnings or revenue. However, analysts are bullish given yet another quarterly earnings beat.

All 3 estimates for 2010 have moved higher since the quarterly results, pushing the Zacks Consensus up to $2.25 from $2.13 per share.

Similarly, looking forward, 2011 estimates are also moving higher as 3 out of 4 estimates rose in the last week. The Zacks Consensus i sup 8 cents to $2.36 per share in that time period.

Value Fundamentals

World Fuel Services continues to be a value stock. The company has a forward P/E of 12.4, well under the industry average of 19.8.

Its other value criteria are also solid. Its price-to-book ratio is 2.1 and its price-to-sales ratio is a really low 0.1.

The company also has a solid return on equity (ROE) of 18.7% whereas the industry average is just 0.9%.

World Fuel Services is a Zacks #1 Rank (strong buy) stock.

Leave a Reply