Macro Man enjoyed the weekend, and not just because the sun made one of its all-too-rare forays from behind the clouds over south-eastern England. Spending a couple of days away from the daily grind of the screens offers a chance for reflection and contemplation, which often pays dividends further down the road.

The drum-beat of short covering (or is that government buying?) continued its inexorable march last week, in the process unearthing the carcasses of yet more once-profitable trades. Over the weeend, it occurred to Macro Man that psychology might offer a useful signpost for determining how far along we are in this process. So he turned to the Kubler-Ross model for dealing with grief. See how far along you are with this process:

Stage 1: Denial. We’ve all been there: “This &%^&*%^ market is so stupid! This thing is gonna turn around any day now once these knucklesheads stop buying.” Check. Macro Man was there in mid-March.

Stage 2: Anger. “Dammit, this is starting to cost me some serious dough. ENOUGH ALREADY!” For Macro Man, stage 2 follows swiftly on from stage 1. It felt like he spent about four weeks in this stage with his Singapore trade.

Stage 3: Bargaining. “If I can just get back to my entry level, I’ll close this position out.” How many times have you said/heard that one in your investing lifetime? And how many times has the individual who uttered it actually closed his risk if he’s lucky enough to see his bad position get back to flat? Most often, emboldened by the eradication of a loss, the temptation is to add, so that you lose even more the next time around.

Stage 4: Depression. “I suck. I’m so cold right now, you have to measure my investment performance on the Kelvin scale.” You don’t have to be Sherlock Holmes to recognize that Macro Man (and, no doubt, numerous others) have been in this spot for a while.

Stage 5: Acceptance. “Well…..there is a lot of cash on the sidelines. I don’t think we’ve seen the lows, but could we nudge up to 950? Yeah, sure we could.” Macro Man knows a few people who think this way, but he’s not sure if it’s consensus yet. To be sure, the majority of readers are bearish equities, and a plurality are short/underweight. Personally, Macro Man reached this point when he started hangin’ with Costanza; while that little foray was profitable, he’s now well out of it and has a relatively blank slate.

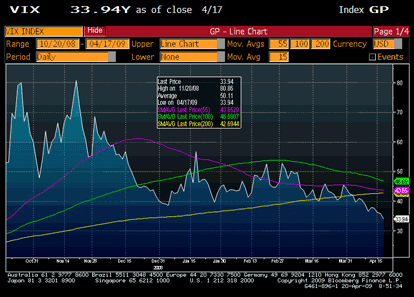

One argument in favour of the market’s being at this stage has been the downdraft in implied volatility across asset classes. VIX is at its lows of the year….

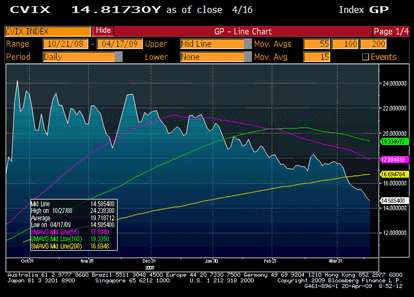

…as is currency vol…

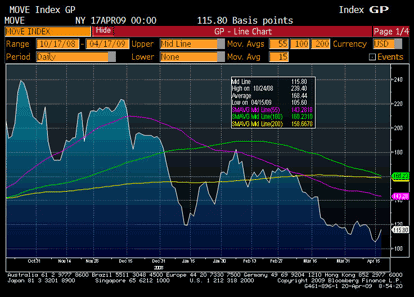

…while fixed income vol is also near its lows.

As befitting someone who’s been through the Kubler-Ross (or at least had a bit of a cold streak), Macro Man has dialled down the risk and is trying to clear his mind. His own medium-term biases remain intact, however, so he looks forward to the day when he can help the weak-handed equity longs and FX carry traders go through their own version of the cycle.

Leave a Reply