Lincoln Electric (LECO) is leveraged to the welding markets around the globe. During the second quarter, the company experienced strong growth from diverse industries including shipbuilding, auto, and construction equipment.

Business

Lincoln Electric is the world leader in the design, development and manufacture of arc welding products, robotic arc-welding systems, plasma and oxyfuel cutting equipment and has a leading global position in the brazing and soldering alloys market.

Growth and Income

The company is expected to grow its earnings per share 63.2% in 2010, 21.1% in 2011, and 22.9% over the long term. Its trailing 12-month return on equity is 10.4%. The stock also offers investors a dividend yield of 2.0%.

This Zacks #2 Rank stock trades at 19.5x 2010 consensus EPS estimates and 16.2x 2011 consensus EPS estimates.

Recent News

On July 27, Lincoln Electric announced second-quarter results. Sales increased 24.8% to $515.6 million. The company earned $0.77 per share, topping the Zacks Consensus by 9 cents, or 13.2%.

Chairman and CEO John Stropki said, “While demand levels have significantly improved in most markets and geographic regions on a year-over-year basis, volume trends are stabilizing. Although recent economic forecasts are more guarded, we remain cautiously optimistic as we continue to pursue market share gains. We believe that our strong financial position will continue to provide the required flexibility to execute our long-term strategic objectives to the benefit of our shareholders.”

Estimates

In the last week, the Zacks Consensus Estimate for 2010 is up 15 cents, or 5.5%, to $2.86, and the Zacks Consensus Estimate for 2011 is higher by 14 cents, or 4.2%, to $3.46.

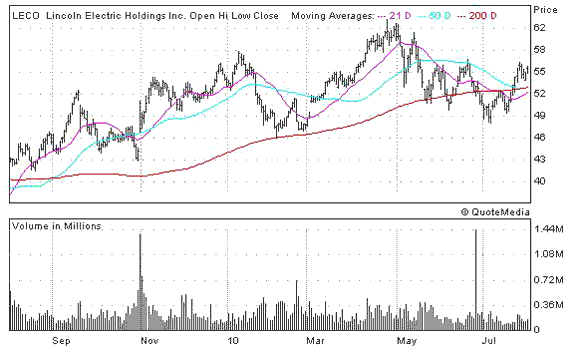

The Chart

LECO shares are up about 29% in the last twelve months. The stock hit its annual high at the end of April. In the recent stock market correction, LECO sold-off 20% before bottoming in early July. In the last month, the stock has rebounded, climbing 11%.

Leave a Reply