Thorfinn pointed out that my recent posts are almost indistinguishable from Krugman’s:

Thorfinn pointed out that my recent posts are almost indistinguishable from Krugman’s:

Why should I bother reading your blog anymore when Krugman is now saying the same thing, with better writing

Believe me, I’d love to stop doing this. I don’t enjoy it and I’m not being paid. I’d much rather write about taxes, and indeed had originally intended to spend July (a slow month!) discussing tax issues. But I keep getting sucked back in.

Unfortunately, it’s even worse than Krugman suggests. No, not the “depression.” I think of it more as a Great Recession. What’s worse is Fed policy.

Krugman and I both think QE is worth a shot, but neither of us think it will accomplish much unless the Fed gets serious about inflation targeting (Krugman) or price level/NGDP targeting (me.) But inflation targeting isn’t even being discussed as an option. The QE option is considered the most radical step currently feasible, and even then only if things get worse. In fact, things are already much worse than the Fed thinks.

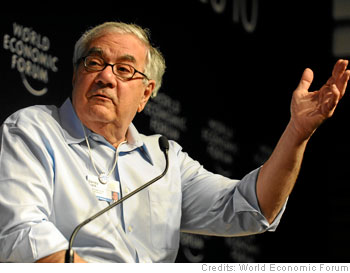

Here’s where Barney Frank comes in. Before the recession began he liked to remind Bernanke of the Fed’s dual mandate (inflation and jobs.) Indeed Barney Frank’s strong opposition to inflation targeting is one reason why the Fed never adopted an explicit inflation target.

Now let’s imagine that the Fed found Barney Frank extremely annoying (it doesn’t matter why, assume they didn’t like his know-it-all manner) and decide that they want to get back at him for stopping them from setting up an explicit inflation target. What is the worst they could do? Well, they could completely ignore their jobs mandate, and focus single-mindedly on inflation. They could say; “We don’t give a damn about 9.5% unemployment, we are going to aim for 2% inflation come hell or high water.” Yeah, I know, that would be really cruel and heartless. And it would be rather arrogant to ignore their dual mandate at a time of 9.5% unemployment. After all, Congress is the Fed’s boss. The Fed is obligated to carry out Congress’s policy goals. But let’s just pretend.

While the policy I just described would be extremely hawkish, and would be blatantly disregarding the Fed’s mandate, Krugman showed in a recent post that their current policy is actually far worse than that. Far more contractionary. Not only are they ignoring their dual mandate (and yes, I know jobs is a stupid mandate, but NGDP would tell the same story) but they’re aiming for less than 2% inflation. How do I know? Because they implicitly acknowledged doing so. Even Bernanke has admitted that long term inflation forecasts from the Fed implicitly reveal the Fed’s target, just as long term unemployment forecasts implicitly reveal their estimate of the natural rate.

The preceding situation would be awful, but the reality is even worse. The Fed thinks they will get inflation up to around 1.25% by 2012, but Krugman argues that is overly optimistic, as inflation usually falls during periods of economic slack. And we have lots of slack. I don’t buy the slack theory of inflation, but the TIPS market that I focus on tells the same story; only about 1% inflation over the next three years, significantly below even the Fed’s forecast. Now I agree that TIPS are imperfect, but the Fed’s track record recently also leaves much to be desired. They failed to forecast the greatest recession since the 1930s until well after the markets were screaming that NGDP expectations were plunging.

But even this understates the audacious way that the Fed is abusing their power. As Bernanke observed in 2003, when you enter a liquidity trap you need to do price level targeting. Because prices have fallen well below the 2% trend line from September 2008 (for core inflation) they actually need much higher than 2% inflation to catch up to trend.

Let’s back up a bit and assume I am wrong about price level targeting and take the most conservative assumption that the hawks at the Fed could use. Assume they don’t trust TIPS, only their own forecasts. And assume they don’t give a damn about jobs, just inflation. A simple, memory-less, inflation target. Even by that criterion they are adopting a far more hawkish policy than could be justified under even the most extreme assumptions. And they are doing it during 9.5% unemployment. And I haven’t heard a word of complaint out of Barney Frank. If he has complained, it hasn’t made any news story that I could Google.

Frank thought inflation targeting was a big problem, and forcefully argued against it around 2006-07. Why is he not holding Congressional hearings on the Fed’s decision to adopt a policy that is much more contractionary that inflation targeting during a period of 9.5% unemployment. If this doesn’t obviously violate the dual mandate that Congress gave the Fed, then I submit that the dual mandate means nothing. What is to stop the Fed from cutting NGDP in half, producing 10% annual deflation and 25% unemployment? They did it once before. You say the Congressional mandate wouldn’t allow the Fed to do that? Then precisely explain to me why the Fed is allowed do what they are currently doing.

Leave a Reply