Analog Devices (ADI) is a cheap tech stock with solid growth prospects and a decent dividend yield.

The company recently reported strong fiscal second-quarter results and gave higher-than-expected guidance for the third quarter.

Growth and Income

The company is expected to deliver long-term earnings per share growth of 10%. The stock also offers investors a dividend yield of 2.9%.

This Zacks #1 Rank stock trades at 13.5x fiscal 2010 consensus EPS estimates and 12.5x fiscal 2011 consensus EPS estimates.

Business

Analog Devices designs, manufactures, and markets analog, mixed-signal, and digital signal processing integrated circuits used in industrial, communication, computer, and consumer applications.

Fiscal Second-Quarter Results

On May 18, Analog Devices announced net sales of $668 million, an increase of 11% from the first quarter of fiscal 2010 and 41% from the year-ago quarter. Gross margin was 65.0%, up from 61.1% in Q1 and 55.1% in Q209.

The company earned $0.55 per share, beating the Zacks Consensus Estimate by 5 cents, or 10.0%. In the last five quarters, the company has beaten the Zacks Consensus Estimate by an average of 41.0%.

President and CEO Jerald Fishman said, “The second quarter was one of the best quarters in ADI’s history. We have substantially grown our revenue in line with a sharpened strategic focus, while fundamentally and significantly improving our operating margin structure.”

Guidance

For the third quarter, the company expects revenue of $695 million to $715 million and earnings per share of $0.59 to $0.61.

Estimates

In the last two months, the Zacks Consensus Estimate for fiscal 2010 is higher by 21 cents, or 10.6%, to $2.19 and the Zacks Consensus Estimate for fiscal 2011 is up 18 cents, or 10.2%, $2.37.

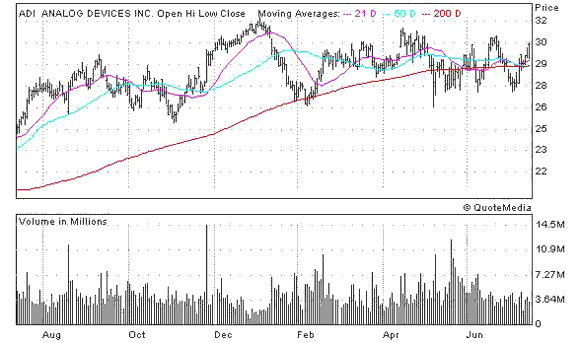

The Chart

ADI shares appear to have strong support at the $26 to $28 level. Resistance is around $32. A break of either one of those levels should point to the direction of the next move. The stock is currently just $2.60, or 8.1% below its 52-week high.

ANALOG DEVICES (ADI): Free Stock Analysis Report

Zacks Investment Research

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply