Policymakers are increasingly stuck between a rock and a hard place. It is likely the recovery remains intact, but at a pace that will fall short of policymakers expectations. Just how far short? That is the key question. In the absence of a fresh financial crisis, in my mind the most likely outcome is that the US economy limps along not unlike the path in the wake of the 2001 recession. Recall that what ultimately pulled the economy off its feet earlier this decade was the housing bubble. There is likely no bubble to pull us out this time.

And an economy that just limps along will put both monetary and fiscal policymakers in a tight position. With interest rates already at rock bottom, monetary policy options of any significance are limited unless the Fed is ready to pump up the money supply via either a commitment to higher inflation or the targeting of long term interest rates. And on the fiscal side, policy is limited by deficit fears. Lacking a clear downward turn in the economy, there is no willpower for large scale stimulus. Which means this: An economy that limps along is on a certain path to a lost decade if policymakers remain incapable of decisive action.

Last week was light on data which, as Calculated Risk opined, may have provided support for equities markets. No chance of “no news is good news” this week. The economic calendar is full, with an important update on the US consumer with Wednesday’s release of the Retail Sales report. Note the Wall Street Journal ran a cautionary tale on retail sales last Friday:

Consumers aren’t stepping up spending at the pace many retailers expected just a few months ago, raising the specter that stores will be stuck with piles of unsold goods later this year.

This dimming retail picture is part of a larger downshift in growth occurring across the economy. Consumer confidence slumped last month and the job market remains weak. On Thursday, the Federal Reserve reported consumer borrowing fell in May, another sign that they are wary about their finances.

All this bodes poorly for the kind of snapback in spending many stores anticipated only a few months ago. Last year’s holiday sales were strong and many retailers expected robust growth to continue through this year, fueled in part by pent-up demand for washing machines and clothes that weren’t bought during the recession.

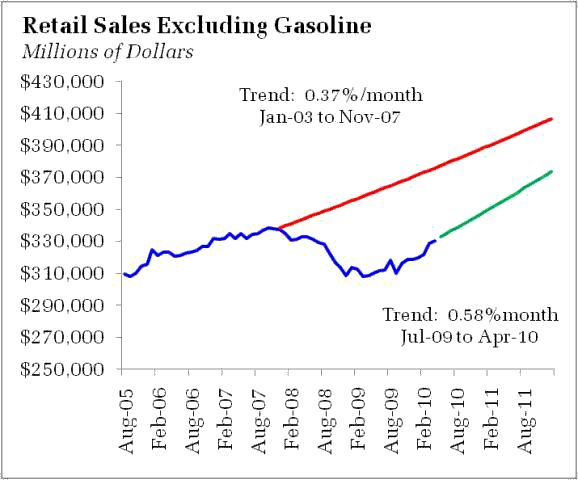

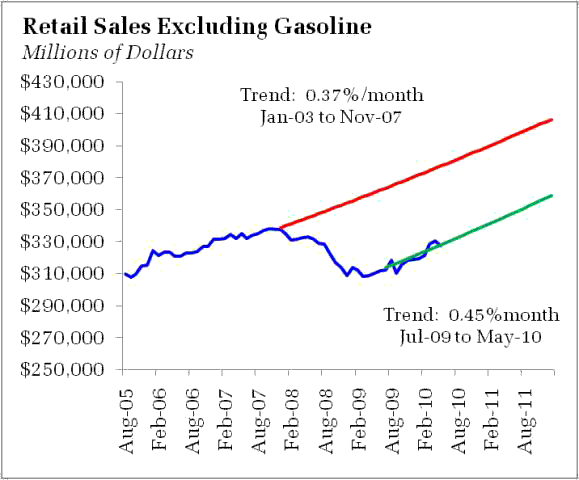

The “robust growth” retailers were looking for was reflected in the trend as recently as April:

Pent-up demand released as job losses came to an end supported that stronger trend – a trend that likely pleased policymakers, as it provided hope that the previous trend could be reached within the scope of current policy. But there might have been less pent-up demand than retailers expected. The May sales drop pulled retailers back closer to the pre-recession trend:

We can even question the sustainability of that trend given weak job growth and declining consumer credit. In any event, the anecdotal evidence presented by the WSJ suggests we should expect the June data to track more closely to the lower trend. Would growth just below expectations be enough to force a policy shift more than an ongoing commitment to ZIRP?

While the Retail Sales report will be especially important, plenty of other interesting data will be in play. Tuesday we get the May International Trade report. Note that the Obama Administration is counting on exports to fuel the US recovery. Note too that they appear to have forgotten about imports; on net, the international sector has reduced GDP the past three quarters. Will it continue to do so? If the external deficit continues to widen, watch for pressure to extend the renminibi’s pitiful advance. On that topic, note that China’s trade surplus rose again in June – interesting, given the Chinese statement:

With the BOP account moving closer to equilibrium, the basis for large-scale appreciation of the RMB exchange rate does not exist.

Also in the line up are a host of data on the manufacturing sector, with Industrial Production, the Producer Price Index, and regional reports from the New York and Philadelphia Feds on the docket for Thursday. We are looking for more evidence that the pace of the manufacturing recovery is fading as producers need to rely on final demand, not inventory correction, to fuel new orders – consistent with the drop in the new orders component of the June ISM manufacturing report.

Finally, the big focus of the week might not be Retail Sales, but the Consumer Price report set for Friday. Any signs of increased disinflationary pressure will weigh heavily on Federal Reserve policymakers, increasing the divide between those who are dead set against further action, a position held most formidably by Kansas City Federal Reserve President and serial FOMC dissenter Thomas Hoenig and more pragmatic policymakers. The question remains: How much disinflation would the Fed be willing to tolerate before they pull out the stops on asset purchases – policy that will look a lot like debt monetization.

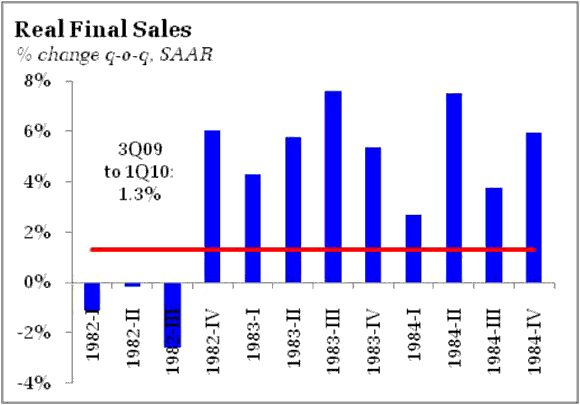

Simply put, what we are looking for is data to define what is shaping up to be a disappointing second half relative to excessive expectations formed as the economy lifted itself off the recession floor. Market participants are waking up to the reality that the recovery is falling far short of the fabled V. Policymakers are beginning to realize the same. Surprising it has taken so long for this realization to sink in. The pace of growth has never been sufficient to rapidly eliminate the gaping output gap. Compare the growth in real final sales over the past three quarters to that of the mid 1980’s:

Excluding inventory dynamics, the pace of activity is falling far short of that necessary to fulfill expectations of a rapid snap back to trend. Paul Krugman reports:

But based on public reporting, like the Ryan Lizza article on Larry Summers — which reads rather differently now that we know how things are really working out, or more accurately not working out — it looks as if top advisers convinced themselves that even in the absence of stimulus the slump would be nasty, brutish, but not too long….So all policy needed to do was meliorate the worst, while we waited for the economy to recover spontaneously.

Policymakers may try to place the blame at the feet of Europe:

The president suggested that troubles in Europe have led to “skittishness and nervousness on the part of the markets and on the part of business and investors.” In brief remarks, the Fed chairman pressed the need to take a global outlook. “I think, very importantly, we also talked a lot about the international context. What’s happening around the world in emerging markets, in Europe affects us here in the United States, and it’s important for us to take that global perspective as we discuss the economy,” Bernanke said

To the extent that Europe is a drag (and at least one Fed official suggests it isn’t, and note that lower interest rates a fueling a mini refinancing boom), quite frankly, it is only icing on the cake. The lack of a V-shaped recovery was baked into that cake from day one, a story that Calculated Risk, for example, has reiterated multiple times. The basic of components of that story remain the same: The lingering impact of financial crisis, the ineffectiveness of monetary policy at the zero bound, and the lack of recovery in the housing market. One does not need to turn to Greece to explain the relative weakness of this recovery.

In short: This week will be data rich. Will that data paint a picture of an economy limping into the second half of 2010, growing, but not swiftly enough to return output to trend and lift rapidly lift employment? Such an outcome should pressure policymakers into additional action. But short of an outright double-dip, will we get anything more than a token policy response? My concern is that policymakers will view a retrenchment in growth as a natural “pause,” simply a delay on the path the strong rebounds that have traditionally followed deep recessions.

Leave a Reply