QE promised so much, yet has delivered so little (even less than yesterday after the poor auctions in the UK and US.)

And so perhaps March is what we thought it was: a month of erratic price action in which positioning trumps all else. It was looking that way anyhow until the SNB dropped their bombshell; and hey, it’s hardly the first time we’ve been in the pain cave.

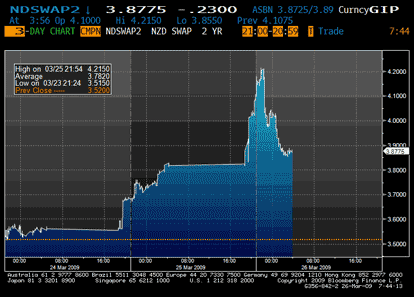

It’s usually not a good sign when Macro Man’s morning inbox is littered with New Zealand fixed income commentaries, and so it proved again this morning. New Zealand rates inexplicably started rising late yesterday in London, continued through the New York afternoon, and then surged into a full-blown panic in early Wellington trade. Stop-losses and rumoured mortgage paying were behind the rise….which abruptly ended as suddenly as it began, taking 2 year rates down nearly 40 bp from where they’d been a few hours earlier.

Yesterday, the Norges Bank cut rates to 2%, as expected, but also hinted that rates would likely trough at 100 bps, lower than the market had priced. They also observed that a somewhat lower krone was naturaly in the context of the global financial crisis. Given that long NOK had been one of the market’s sacred cows, it naturally took a swift trip to the abattoir.

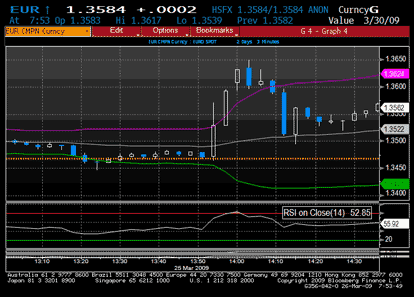

Yet even that wasn’t the FX pain trade of the day, pride of place must go to the farce surrounding some comments from Tiny Tim yesterday. Speaking at the CFR, Geithner said that although he hadn’t read PBOC governor Zhou’s recent proposal, he was certainly open to expanding the pool of IMF SDRs. This was an innocuous enough comment, as the IMF is likely set to see its funding levels increase dramatically.

Yet somehow the Reuters newswire managed to run this comment into a headline suggesting that Geithner was open to using the SDR as an anchor in a new multilateral reserve currency, i.e. ending the dollar’s current dominance. Unsurprisingly, the dollar got swiftly smacked (leaving dealers shouting “WTF!?!” until the offending headline was spotted), retracing part of the losses after a hasty clarification was made.

Remember, policymakers: stay on message, keep it clear, and keep it simple. Although one thought did occur to Macro Man yesterday. Given the yawning size of the US budget deficit, perhaps the Federales have decided to generate a little revenue on the side, a la Voldemort and friends? Perhaps the US Treasury has decided to buy overnight options in EUR/USD, and then let Geithner step up to the mike. Hedge your gamma, and boom! You’ve paid for half an hour of bank bailouts. Yippee!

Finally, a video clip that both gladdens and saddens Macro Man. While he is pleased to see the government inquiring into the shadowy cabal at the heart of the banana republic, can we really not do any better than Maxine Waters? Really, she shouldn’t be running a lemonade stand, let alone part of the US government. The look on Geithner’s face when she misunderstands the difference between a chief of staff and CEO is priceless. It’s a small ray of light in an otherwise dark and chilly pain cave…

[video1]4ugpIryLGtI[/video1]

Leave a Reply