A recent post by Arnold Kling contrasted Keynesian and monetarist views of nominal income determination. At one point Kling expressed some doubts about the efficacy of open market purchases when the economy is in a liquidity trap. This is of course a complicated issue, and it mostly depends on whether the currency injections are expected to be permanent or temporary. (It doesn’t really matter whether rates are at the zero bound.) But one particular analogy caught my attention:

A recent post by Arnold Kling contrasted Keynesian and monetarist views of nominal income determination. At one point Kling expressed some doubts about the efficacy of open market purchases when the economy is in a liquidity trap. This is of course a complicated issue, and it mostly depends on whether the currency injections are expected to be permanent or temporary. (It doesn’t really matter whether rates are at the zero bound.) But one particular analogy caught my attention:

In other words, as a central banker, you can go on for years observing a nice relationship between a monetary aggregate and the economy. However, the minute you attempt to manipulate the economy by altering the supply of that monetary aggregate, the relationship will break down.

For example, suppose that the central bank were focused on the quantity of nickels in circulation. Over the past twenty years, let us say, the velocity of nickels (that is, the ratio of nominal GDP to the number of nickels in circulation) has evolved along a predictable trend. One day, the economy sinks into recession, and the Fed decides that it wants to use its control over the quantity of nickels to try to boost nominal GDP. It undertakes a massive open market operation, in which it exchanges vast quantities of nickels for pennies, times and dollar bills. Based on the trend velocity of nickels, the Fed expects this to have a dramatic effect on the price level and on nominal GDP.

In fact, it is hard to imagine that a vast open market operation to exchange nickels for other currency denominations would have much effect on GDP. People would probably keep more nickels in the drawer and fewer coins of other denominations. The velocity of nickels would plummet, and otherwise life would go on.

In today’s economy, it is difficult to imagine the Federal Reserve exerting tight control over the medium of exchange. Many transactions use credit cards and debit cards. Many mutual funds allow checks to be written against the assets in the fund.

I think his argument is wrong, but it is wrong in an interesting way. Of course he is right about all the problems with the Quantity Theory of Money—it is not a reliable relationship. But the nickel analogy doesn’t show what he thinks it shows.

In our monetary system the Fed controls the monetary base (directly or indirectly), and then lets the public decide how to partition the base among the various currency denominations. We know exactly what happens if the Fed (or Treasury) doesn’t do this–you get coin shortages or surpluses. If the Fed arbitrarily exchanges dimes for nickels it will not be inconsequential, as Kling seems to suggest. There are two possible outcomes, either the value of nickels will rise above par value, or more likely there will be shortage of nickels. People will go to the bank, ask for a roll of nickels, and find that the bank is out of them. Then they will waste time checking out other banks (the equivalent of queuing costs.) Alternatively, banks might charge $3 for a role of nickels that normally costs $2. Either way, Kling’s analogy doesn’t hold.

If nickels sell for $3 a roll, or 7 1/2 cents each, then they are no longer “money” in the sine qua non sense of all monetary models–they are no longer the medium of account. Monetary theory is the theory of the value, or purchasing power, of the medium of account. More likely there would be shortages, but the par value would stay at 5 cents. But even in that case the analogy doesn’t work, as (unlike nickels) changes in the overall monetary base through open market operations do not result in surpluses or shortages of base money. Instead, the prices of all other non-monetary goods, services, and assets adjust to equate the supply and demand for base money. Of course in the long run it is goods and services prices that adjust. But since those prices are sticky, asset prices (including interest rates) adjust in the short run. But even in the short run there is no shortage or surplus of base money. People can always get cash in exchange for foreign currency, or stocks, or T-bonds, if they so choose. So either way the nickel analogy doesn’t work.

But my response to Kling has a very interesting implication; a reduction in nickel supply caused the Great Depression. This is a point I made last year in a post entitled “The Autistic Macroeconomist.” I don’t recall it attracting as much controversy as I expected–maybe people thought I was joking. The basic ideas were as follows:

- For any given monetary base, the quantity of nickels in circulation is endogenous, determined by the public’s preferences.

- Nickels are generally used in transactions (or piggy banks), and are not widely hoarded during financial crises.

- In the early 1930s the monetary base rose sharply, while M1 and M2 fell sharply.

- In the early 1930s the quantity of smaller transactions denominations fell, while the larger denominations that tend to be hoarded rose sharply.

- The Fed doesn’t directly control the supply of nickels, or the supply of M2, rather both respond endogenously to changes in NGDP, which responds to changes in the supply and demand for base money.

- If the Fed had adopted a monetary policy that led to continued normal growth in small denominations, the Great Depression never would have happened.

- It is just as true that the Great Depression was caused by a reduction in nickel supply, as a reduction in M2 (Friedman and Schwartz’s claim.)

If I had to pick one post to have Paul Krugman read, it would be (part 1 of) ”The Autistic Macroeconomist.” It’s probably my favorite post. I took his criticism of Friedman and Schwartz’s focus on M2, and went one step further. Plus he likes clever counterintuitive stuff, and I think this might be my most counterintuitive post. If only I had recalled it when the GMU professors asked me for my most outrageous belief.

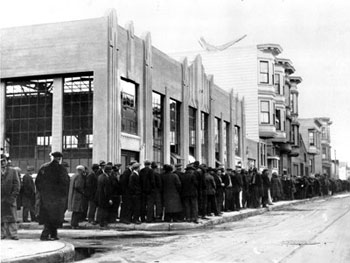

PS: Here is US nickel output:

- 1929: 52.5 million

- 1930: 28.3 million

- 1931: 1.2 million

- 1932: 0

- 1933 0

Back then a nickel was more like 50 cents or a dollar today.

PPS: Kling starts his post with the following observation:

Here is the long-awaited section on monetary theory. If you ask me the question, what will happen if the Fed stops paying interest on reserves, my answer would differ from Scott Sumner’s. I would say, “Not much will happen in the overall economy.” Bank profits will be a little lower, and Federal Reserve profits (which are rebated to taxpayers) will be a little bit higher, and that is about it.

That’s a fair comment, but just to be clear I believe the removal of interest on reserves might have a significant expansionary effect. I would certainly concede that it might not, especially if the Fed continues its contractionary policy of promising to shrink the bloated monetary base before inflation can rise.

Leave a Reply