AmeriCredit Corp. (ACF) analysts are raising estimates heading into the next earnings release, which should be in a few weeks. Growth is expected to be exponential and one rating agency has upgraded the company’s debt.

Company Description

AmeriCredit Corp. provides auto financing through dealerships in the U.S. Currently, ACF has about $9 billion in receivables from 800,000 customers with less than perfect credit.

Sixth Straight Surprise

The most recent quarterly announcement was back on Apr 21, but it was a good one. AmeriCredit drastically improved its net income to $63 million, from a $2 million loss the year prior.

Earning broke down to 45 cents per share, easily beating the 27 cents that analysts were expecting. AmeriCredit has now beaten the Zacks Consensus Estimate in each of the past 6 quarters.

While unemployment remains high and consumers are still under pressure, the numbers for AmeriCredit continue to improve. Originations have almost doubled and delinquencies by percentage are down.

Estimates Rising

Analysts raised full-year estimates after the earnings release. The Zacks Consensus Estimate for fiscal 2010 jumped 28 cents, to $1.33. In the past month we have seen another 5 revisions, lifting the consensus another 3 cents. Rising estimates heading into a quarterly report is a great sign.

Estimates for next year jumped 31 cents on the news and another 7 cents in the past month. Compared to the 17 cents earned last year, the annual growth rates are expected to be over 700% and 6%, respectively.

Valuations

AmeriCredit is trading with a forward P/E under 13 times and with a PEG of 1.2, making the growth not quite a bargain but you won’t be over paying. The Price to book is just over 1.0.

It may be counter intuitive, given a rough economy and tight credit, but the industry ranks 16th out of 264 right now. Of the 13 companies in this area AmeriCredit comes in first.

Fitch Upgrades

On May 27 Fitch ratings bumped up its rating on AmeriCredit’s long-term and senior debt, which is more than $500 million. The ratings remains “speculative” but Fitch cited improving profitability thanks to tighter standards.

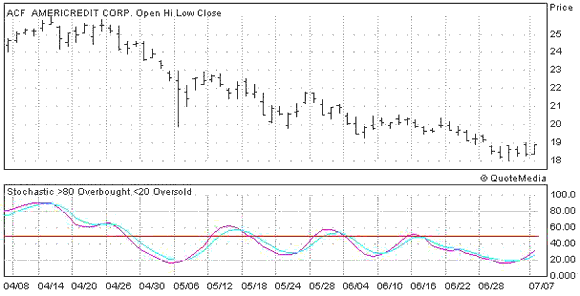

The Chart

Shares of ACF are not going to woo any momentum investors, but we could see shares stabilize here after hitting “oversold” territory. If you have the stomach to pick up ACF, this could make for an excellent entry point.

Leave a Reply