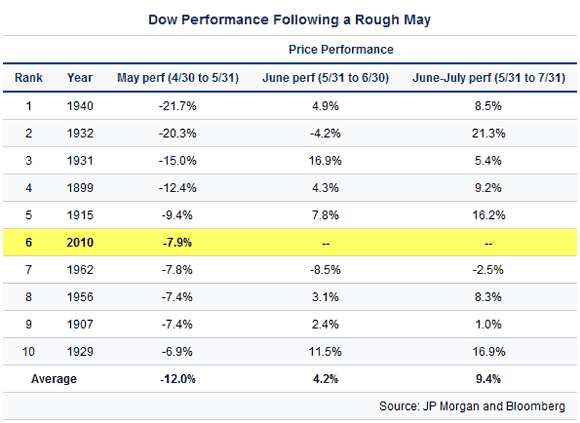

May was a brutal month for stocks. The 7.9 percent decline in the Dow ranks as the sixth worst in history but a report from JP Morgan shows that could bode well for the summer.

The table shows the 10 worst May declines in Dow history followed by subsequent June and July performance. Combined, the average decline for the 10 worst Mays was 12 percent, then a 13.6 percent average bounce back (4.2 percent in June, 9.4 percent in July) over the next two months.

The Dow has traded up during June-July 8 out of 9 times (89 percent) when following one of the worst Mays in terms of performance. The only year to not see a June-July bounce back was 1962 when the market dropped an additional 11 percent.

On average, the Dow has traded positive 59 percent of the time in June-July dating back to 1897.

We haven’t seen anything resembling a bounce back yet but market hangovers from a bad May have tended to linger eight days into the following month. The worst was in 1932 when the market didn’t recover well into July.

While historical data certainly doesn’t ensure how June-July 2010 will shake out, statistics like these can help our portfolio team take advantage of market cycles.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

Leave a Reply