Toll Brothers Inc. (TOL) today announced earnings results for its second quarter ended April 30, 2010.

Toll Brothers Inc. (TOL) today announced earnings results for its second quarter ended April 30, 2010.

The company said its Q2 loss narrowed to a net loss of $40.4 million, or $0.24 per share, compared to 2009’s second-quarter net loss of $83.2 million, or $0.52 per share. Revenue fell 22% on a y/y basis to $311.3 million, less than the average estimate of $324.8 million.

During the quarter the luxury homebuilder reported for the first time in 16 quarters an increase in land holdings, spending $143 million buying land which represent a 6% increase by lots on the previous three months. Apparently, Toll Brothers anticipates a recovery in the housing market.

“It appears our business has finally emerged from the tunnel and into a bit of daylight,” Chairman Robert Toll said in the statement. “May’s activity suggests that for us the tax credit wasn’t the determinative factor – rather, we believe, the past few months’ activity has been driven by an increase in confidence among our buyers in their job security, their ability to sell their existing homes, and general trends in home prices.”

Toll also said its net contracts of $464.6 million and 820 units, increased by 56% and 41%, respectively, compared to 2009’s second-quarter net contracts of $298.3 million and 582 units. The co. ‘s contract cancellation rate came in at 5.3% compared to 21.7% in 2009’s second quarter.

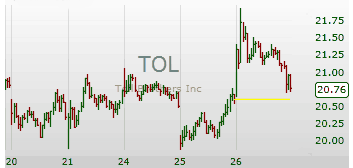

TOL shares closed at $20.78 on the NYSE, but turned fractionally lower $-0.01, or (-0.06%), to $20.77 in extended trading.

Leave a Reply