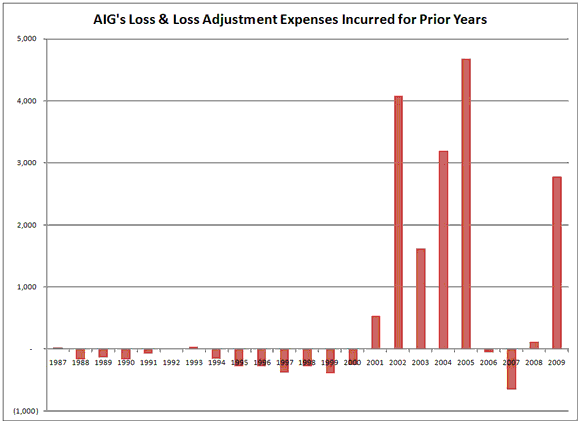

The above graph is lovingly culled from AIG’s 10-Ks for the past 23 years. It tells an amazing story, in my opinion, and you will get my view of AIG’s reserving. I am somewhat biased because I worked for AIG from 1989-1992, and some of that bias is expressed in the paper I wrote on AIG’s operating insurance subsidiaries, in the first three pages.

A key figure in reviewing reserving is how much a company increases or reduces reserves due to claims from business written in prior years. Good companies set initial reserves conservatively, and slowly adjust reserves downward as time progresses, and claims emerge below estimates.

What’s that, you say? Doesn’t GAAP require reserves to be best estimates? Well, yes, technically it does. But no one, not even the actuaries internal to P&C insurers or reinsurers can be truly certain about what the best estimate is. Thus, investors in insurance companies have to be confident that the management teams are being conservative, or at least neutral in their judgment on reserves.

But here is the reserving story on American International Group (AIG): up until 2000 AIG generally released reserves for the business written in prior years. Toward the end, they probably released more than they should have.

AIG was one of the consummate growth companies in the financial space in the 1990s. It grew faster than most financials, and did not lose luster during the dot-com era. Indeed, its price only peaked in early 2001, shortly after reporting their annual earnings. After that, AIG went from being a growth stock to being a non-growth stock, and its P/E multiple fell.

Now, perhaps AIG goosed its earnings by setting reserves too low in the late 90s. That is possible, and it may have led to the need to restate reserves higher in 2001-2002. By 2002, all of the reserve releases of the past 15 years were wiped out.

In the investment community 2002 was a “big bath,” where AIG took significant one-time losses to reset its balance sheet and continue its growth. But it was not enough. 2003 and 2004 had continued strengthening of reserves for past business written.

In 2005, Greenberg was shown the door, and Martin Sullivan took over. The 2005 restatement of reserves for business written prior to 2005 was huge. I suspect Martin Sullivan was trying to clean things up. Maybe it worked; in 2006 and 2007, they released excess reserves.

In 2008, there was a small degree of reserve strengthening, but nothing compared to the other problems at AIG. In 2009, strengthening was significant, possibly reflecting new efforts to clean up, or perhaps like my comment in the paper I referenced above:

Reinsurance does carry a risk, though, if the reinsurer can’t or won’t pay. AIG’s rather sharp handling of reinsurers in the past carries with it the risk that reinsurers will be less than sympathetic to their problems. Because of AIG’s difficulties, reinsurers will be more likely to try to deny claims while AIG is weak. And like the parable of the unjust steward, some AIG employees might be inclined to compromise at levels fairer to the reinsurer. After all, opportunities at AIG are ebbing, but having friends in the industry is always an aid when looking for work.

One final note on the table: 2004 and after, AIG adjusted their prior year incurred figures for foreign exchange fluctuations, and interest that needed to be accrued, because they discounted their reserves. Those factors should not make a ton of difference to the 2003 and prior years. Magnitudes might change but the overall story will not change.

Summary of AIG’s Behavior

There came a point in the life of AIG, in the late 90s, where management pushed reserves to be less conservative. By 2003, the ruse was obvious, and though AIG was added to the Dow Jones Industrial Average, the stock never attained to its 2001 highs.

Possible Policy Advice

The process of P&C reserving, after reviewing the results of AIG almost begs to have a valuation actuary statute for P&C companies the way companies do, but for a different reason. Life companies do stress tests on cash flow mismatch, credit sensitivity and more. It’s a confidential document that the regulators can look at, but the public can’t.

For P&C companies, the actuaries would have to spell out their valuation methods down to all of the major parameters and methods by line of business, and then roll them forward from the last year in order to show the effects of parameter changes, method changes, and adverse or favorable development.

I can hear the squealing from P&C companies now. That said, my peers in Casualty Actuarial Society would send me a box of chocolates for the new “Actuarial full employment act.” ;) File a GAAP version confidentially at the SEC; then have the SEC hire a staff of Casualty Actuaries to review the filings in detail, and offer suggestions for dealing with egregious violators.

That’s what it would take to get reserving for P&C companies straightened away. I could suggest it to the SEC/NAIC, but they aren’t that concerned about reserving at present because most companies seem to play fair. AIG did not, and perhaps still does not play fair in this area in my opinion, but they were an outlier in the industry that got special treatment because of their size, complexity, and seeming success.

Final Summary

AIG was an outlier, but that does not mean it can’t teach us a few things. First, don’t trust P&C reserving, particularly of big companies. Second, look to see if management teams reserve conservatively — do they release reserves consistently year after year? (Which means they set reserve high for the current year’s business. Tough to do, because setting reserves low on the current year’s business is the easiest way to show good profits in the short run.

Third, someone paying attention to reserve strengthening would have exited AIG in 2003 or 2004, after two or three large reserve strengthenings. This brings up a subsidiary point. M. R. Greenberg is responsible for the trouble that occurred at AIG, not Sullivan, or anyone that followed. The huge reserve adjustments occurred under M. R. Greenberg’s watch, not anyone else.

So, no prior to 2000, AIG was probably not underreserved. After that, most definitely is was underreserved. Today? Who can tell? Ask me in a few years.

Leave a Reply