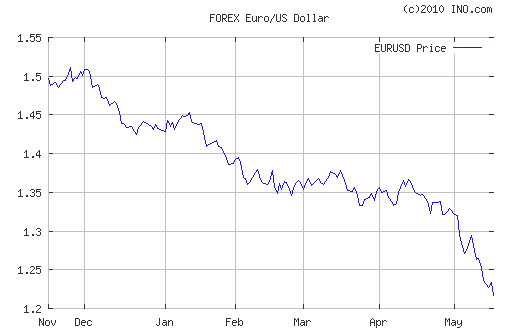

Since mid-April, the euro has depreciated 10% against the U.S. dollar and European stocks have lost 17% of their value. But markets aren’t acting as though the problems will be confined to Europe.

Dollars per euro. Source: Ino.com

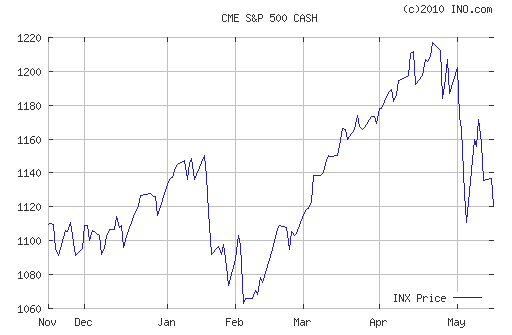

Since April 15, the S&P500 index of U.S. stock prices and Japan’s Nikkei 225 are both down about 8%. China’s SSE is down 18%, presumably weighed down by domestic concerns in addition to any reaction to developments in Europe.

U.S. S&P 500 stock index. Source: Ino.com

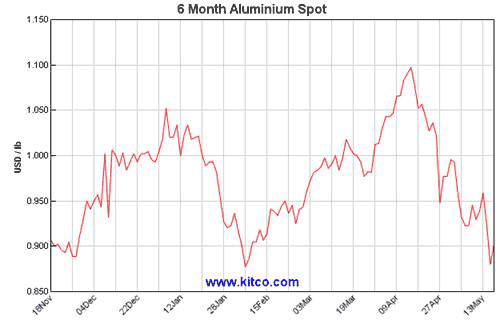

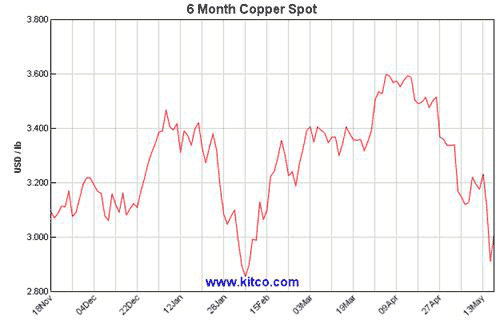

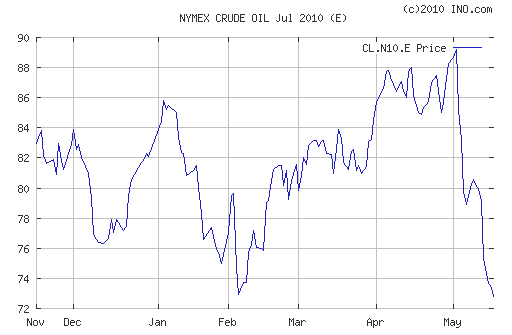

The dollar prices of aluminum, copper, and oil are each down 16-19% as well.

Aluminum spot price in dollars per pound. Source: Kitco

Copper spot price in dollars per pound. Source: Kitco

Crude oil price in dollars per barrel. Source: Ino.com

The curious thing is that those last four graphs all look the same. Which suggests to my simple mind that recent market moves have a common driving factor.

The natural explanation would seem to be that markets have interpreted developments over the last month as bad news in terms of the quantities of basic raw materials that global customers will want to buy and in terms of the profits that companies around the world can expect to earn.

Such concerns would have to come not just from the fact that the European countries forced into budget austerity measures are going to be buying less. Worries about sovereign debt could translate into a reduced willingness to lend to any number of private borrowers in a potential replay of the credit crunch that brought the world economy crashing down in the fall of 2008.

So far such concerns have not had a major effect on banks’ borrowing costs. The TED spread has climbed 15 basis points since April 15, but is still nowhere near the levels we saw during the dramatic credit events of 2008.

TED spread (3-month LIBOR minus 3-month U.S. T-bill rates). Source: Bloomberg

Moreover, the declines in stock market values and commodity prices since April have only served to reverse the gains in March. So perhaps it’s most accurate to describe developments so far not as a conviction that we’re on the verge of replaying events of 2008, but simply as a realization that the global economic recovery is not as strong as it appeared to be just a month ago.

But the news coming next out of Europe and China will be watched with great interest by the rest of the world.

Leave a Reply