University of Maryland Professor Boragan Aruoba (of the Aruoba-Diebold-Scotti Business Conditions Index fame) has an interesting new paper that offers another perspective on the challenges facing Europe.

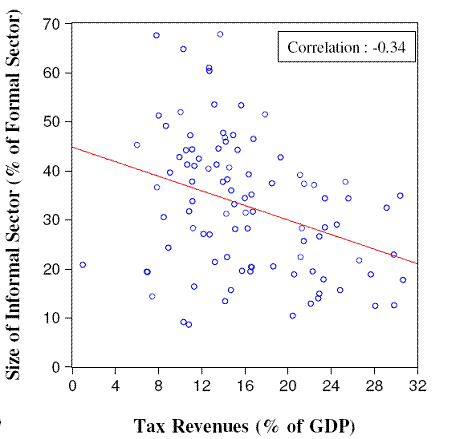

Aruoba’s paper notes some interesting regularities in a data set of 118 different countries. One measure he looks at is the size of the underground economy in different countries. If you carry out your business in the underground economy, you will benefit by avoiding taxation, but you lose the legal and contract protection that you would have had if you’d instead been working in the formal sector. If only the first effect mattered, you’d expect to see countries with higher tax rates have a greater role for the informal sector. But Aruoba finds just the opposite– the bigger the informal sector, the lower tax receipts as a percent of formal-sector GDP. Aruoba attributes this to the fact that in countries with better legal institutions, the benefits of conducting business above board outweigh the taxation costs, and the governments can afford to raise more of their revenue through traditional taxation.

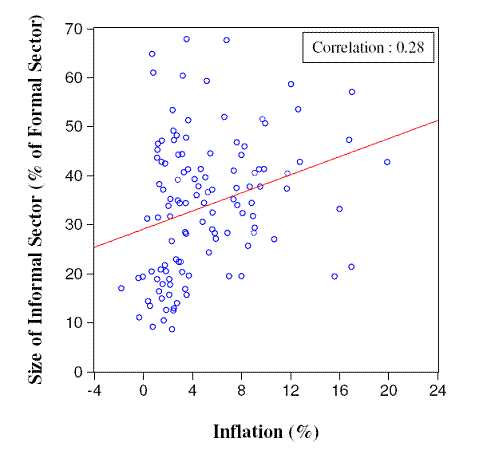

But how can governments with weaker institutions and a bigger underground economy raise revenue? Even though much of economic activity is outside of the government’s control, the government can still tax that activity by choosing a higher inflation rate. Aruoba argues that this explains why countries with a bigger informal sector often also tend to have higher inflation rates.

Aruoba’s interpretation is that the weaker a country’s institutions, the greater the attractiveness of the informal sector, and the more the government is likely to rely on inflation rather than standard taxes to raise revenue.

Aruoba’s interpretation is that the weaker a country’s institutions, the greater the attractiveness of the informal sector, and the more the government is likely to rely on inflation rather than standard taxes to raise revenue.

I was thinking about these correlations as we all ponder the storm clouds over Europe. Joining a common currency unit means losing the ability to adapt monetary policy to your own country’s cyclical conditions. But it also means surrendering to your neighbors’ long-run mix of formal-sector taxes rather than inflation as a source of government revenue. Here’s an estimate of how the size of the informal sector differs across the countries in the news at the moment.

Tyler Cowen thinks those bars look unsettlingly like dominoes.

Graphs: Aruoba (2010), Multiplier effect

Leave a Reply