With gold reaching new highs, I appeared on CNBC’s “Power Lunch” this week to discuss the drivers behind this upward move.

While many think the move is fear-driven, I think it’s more a case of smart investors looking to preserve their wealth against unstable government and monetary policies.

I explained that the three important global factors affecting gold prices at the moment are (1) negative real interest rates, (2) massive government deficit spending and (3) huge increases in money supply.

Whenever you have these three factors, … gold will perform exceptionally well in that [country’s] currency. Right now, what we’re seeing is still big deficits and negative real interest rates…the reason that you have negative interest rates is because the world is fighting deflation and we’ve been on this huge deflationary cycle.

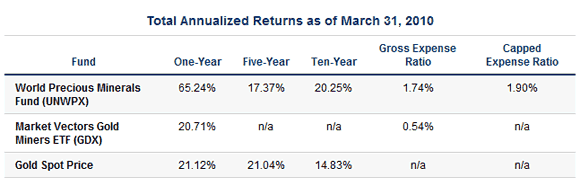

The World Precious Minerals Fund (UNWPX) was first in total return among all U.S. gold-oriented mutual funds and exchange-traded funds for the year ended December 31, 2009. The fund was ranked #1 of 71, #34 of 51 and #18 of 29 among gold-oriented funds by Lipper for the 1-, 5- and 10-year periods ended December 31, 2009. The fund was ranked #3 of 74, #35 of 52 and #19 of 31 among gold-oriented funds by Lipper for the 1-, 5- and 10-year periods ended March 31, 2010.

Gross expense ratio as stated in the most recent prospectus. Capped expense ratio is a voluntary limit on total fund operating expenses (exclusive of any acquired fund fees and expenses, performance fees, taxes, brokerage commissions and interest) that U.S. Global Investors, Inc. can modify or terminate at any time. Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus (e.g., short-term trading fees of 0.50%) which, if applicable, would lower your total returns. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.High double-digit returns are attributable, in part, to unusually favorable market conditions and may not be repeated or consistently achieved in the future.

The World Precious Minerals Fund is an actively managed fund that focuses on selecting junior and intermediate precious metals exploration companies from around the world. The volatility of these smaller mining companies is typically greater than that of senior producing companies. The Market Vectors Gold Miners ETF is a passively managed fund that seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index. The World Precious Minerals Fund can be purchased or sold at a net asset value determined at the end of each trading day. The Market Vectors Gold Miners ETF can be intraday purchases and redemptions that may generate brokerage commissions and charges not reflected in the ETF’s published expense ratio. Loss of money is a risk of investing in both the World Precious Minerals Fund and the Market Vectors Gold Miners ETF. Shares of both the World Precious Minerals Fund and the Market Vectors Gold Miners ETF are subject to sudden and unpredictable fluctuations in value. The Market Vectors Gold Miners ETF may also be subject to bid-ask premiums or discounts to NAV that could adversely affect a shareholder’s actual returns. The World Precious Minerals Fund intends to make distributions that may be taxed as ordinary income or capital gains. The Market Vectors Gold Miners ETF is designed to not generate taxable gains for shareholders, but there is no guarantee that the ETF will achieve that objective.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. COMEX Gold represents the spot price for gold as traded on the COMEX commodity exchange. Diversification does not protect an investor from market risks and does not assure a profit.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply