Gold has benefited from worries that Greece’s debt crisis is just the beginning of a contagion that may spread through Western Europe’s ailing economies and possibly even threaten the viability of the euro.

And on top of that, the head of the Philly Fed was talking up the medium-term inflation risk today, and reports from around the world – from Australia to China to Brazil to emerging Europe – show rising inflationary pressures. This, of course, also tends to be good for gold.

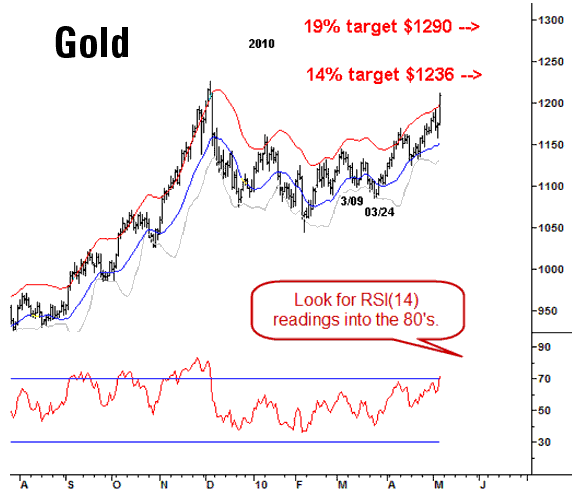

The smart folk at Institutional Advisors in Vancouver took a look at the technicals and applied some history. Here’s their view, with their chart:

Targets based upon the 1980 to 2007 consolidation continue to point to levels above $2,000. In the short term, the mid-March bottom suggested strength would be see through late May or early June… The pullback to test the breakout of $1,160 on May 4 and 5 alleviated the “urgency,” leaving the market free to rally once again. Upside targets for the next few weeks start at $1,236, with the most common advance being 19% ($1,290) from mid-March, but surprises could be to the upside…

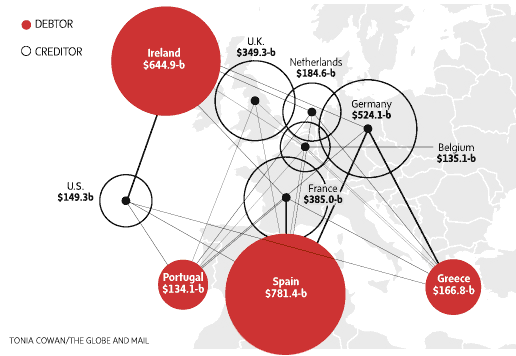

The Globe and Mail in Toronto put together a good visual (below) on how financially exposed the larger and stronger economies of Western Europe are to the region’s teetering nations. Think of all the turmoil caused by Greece – the external debt load of Spain and Ireland together is more than eight times greater.

Some analysts have said that euro weakness is usually not a positive for gold, but the specific fears created by the debt crisis make gold more attractive to many investors as a safe haven even at prices near $1,200 per ounce.

Leave a Reply