Yesterday I showed how the Census Bureau New Home Price Index, adjusted for inflation, was no lower — probably higher — now than it was throughout the 1990s.

Remarkably, several bloggers attack the piece on the basis that the Census Bureau index is supposedly not quality adjusted. That’s a funny claim, because the Census Bureau refers to the index as the “Constant Quality (Laspeyres) Price Index of New One-Family Houses Sold.”

I clearly explained that I chose that index because it dates back far enough to examine other housing cycles (e.g., those in the 1970s and early 1980s), which gives me a historical basis to model how supply and demand would react in various hypothetical situations.

But let’s suppose that one did not want to engage in such an exercise, and thereby had the freedom to use other indices: my conclusion from yesterday — that real housing prices are still high by historical standards — would be even stronger!

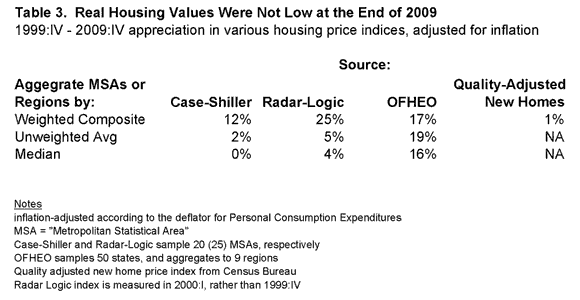

To see this, compare the end of 2009 with the last quarter of 1999 or the first quarter of 2000 (that’s as far back as some of the alternative indices go), as I have in Table 3. The last column of the Table has the index I used yesterday, and it shows the LOWEST 2009 real housing price relative to 10 years ago, with one exception. Eight other measures show MORE of an increase over 10 years.

The various national measures disagree much more on the amount by which real housing prices increased 2000-2006, with a range from 20% (Census Bureau quality-adjusted new homes) to 73% (Radar-Logic). A significant part of the disagreement relates to the weighting of the various regions to form the national composite, which is why my Table 3 also reports unweighted averages of the regions, and real price changes for the median region.

Leave a Reply