Ooooohhhh boy. That wasn’t part of the rescue plan, was it?

The standard approach to crisis management is “UPOD”: under-promise, over-deliver. This is the “shock and awe” approach to bailouts that we saw last spring (via huge QE programs and a Dr. Evil-esque allocation promise to the IMF, which hasn’t done much good for Greece, it must be said!)

Sadly for holders of risk assets, the Europeans have taken the more treacherous “OPUD” strategy: after talking about sums as high as €130 billion last week, the Greek program underwhelmed that figure by €20 bio or so.

And so Greece came under the kibosh yesterday, dragging the rest of the world’s risky assets with it. While there’s no real trading in Greek 2yrs anymore, the best guess yield is now about 15%. That’s not good.

(click to enlarge)

The obvious question therefore becomes: what now? What happens when the authorities hit Greece with their best shot, and it just ain’t good enough? Well, for starters, the rumour-mongers start hunting bigger game, like Spain. While yesterday’s “Fitch downgrade” rumour proved to be unfounded, there are enough tendrils of smoke wafting up from Iberia to suggest the presence of fire. (Unless those are just ash clouds from Iceland…..)

While the SPX got a rather rude tap yesterday, ’twas little more than a peck on the cheek compared to what’s been happening in the IBEX. The Spanish index is nearly 20% off of its January highs, has broken a previous low, and really needs to reclaim the technically significant 10,000 line quickly or else face risk of a splattering.

(click to enlarge)

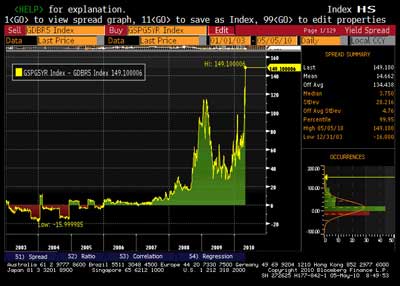

More ominously, the yields spread between Spanish bonds and Bunds has crept to a post EMU high. The chart below shows the yields spread in 5yrs, at nearly 150 bps….but the picture looks similar elsewhere along the curve as well. It’s one thing for a little country like Greece to have a yield blow out…..it’s quite another for one of the larger Club Med countries (and your next World Cup champions….) to go haywire.

(click to enlarge)

Hmmmm. What’s a poor policymaker to do? From Macro Man’s perch, the eventual outcome is looking more and more inevitable. Remember last year, when J-C Trichet used to waggle his finger during press conferences and looked down his nose at the Anglo-Saxon money-printers?

Karma’s a bitch, ain’t it? For it’s looking increasingly likely that the ECB will need to step in and buy Eurozone government bonds…particularly those at the periphery. They’ve already ejected the ratings agencies from the equation and torn up the collateral eligibility rulebook….why not go the whole hog into outright QE?

Sure, the Bundesbankers won’t like it…..but the German exporters clearly will as the euro heads down the pan! Note how the € is losing serious ground against even sterling, the currency of a country with Moe, Larry, and Curly vying to be prime minister.

Tomorrow’s press conference might be a bit to soon for the ECB to announce QE…but then again, maybe it won’t.

Leave a Reply