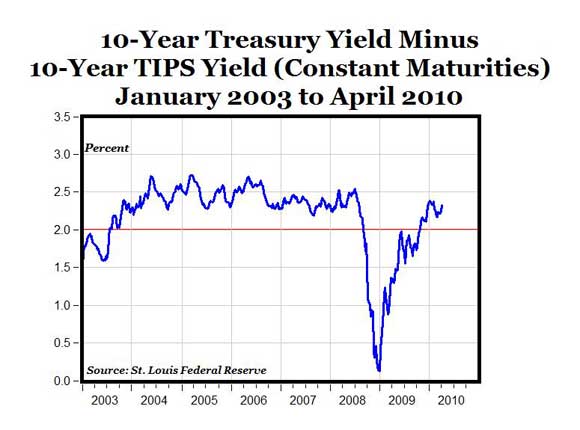

The spread between nominal 10-year treasuries (data) and 10-year TIPS (data) has increased slightly over the last few months, to the current level of 233 basis points as of April 9. But the current spread is still below the 250 basis point average during 2004, 2005, 2006, 2007 and the first half of 2008. This market-based indicator of expected inflation is a little higher than the 1.9% consensus of the WSJ forecasters. At least by this Treasury bond-market derived estimate of future inflation, there don’t appear to be any inflationary pressures building.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply