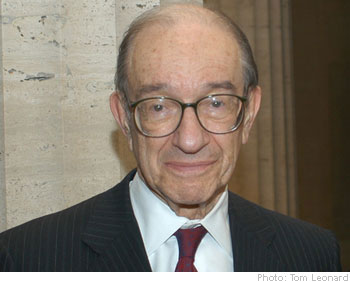

April 7 (Bloomberg) — Former Federal Reserve Chairman Alan Greenspan defended the central bank’s record on consumer protection in the years before the financial crisis…. “The Federal Reserve, often in partnership with the other federal banking agencies, was quite active in pursuing consumer protections for mortgage borrowers,” Greenspan said in testimony for a hearing today of the Financial Crisis Inquiry Commission in Washington.

April 7 (Bloomberg) — Former Federal Reserve Chairman Alan Greenspan defended the central bank’s record on consumer protection in the years before the financial crisis…. “The Federal Reserve, often in partnership with the other federal banking agencies, was quite active in pursuing consumer protections for mortgage borrowers,” Greenspan said in testimony for a hearing today of the Financial Crisis Inquiry Commission in Washington.

April 7 (Bloomberg) — “There’s a lot of amnesia that’s emerging,” Greenspan said.

The attention Alan Greenspan devoted to consumer protection on April 7, 2010, was a strange diversion, which is what it was. The Financial Crisis Inquiry Commission had penetrated, to an uncomfortable degree, the shallow defenses Greenspan has dreamt up to justify his indefensible behavior. For instance, he offered a ridiculous response when asked if monetary policy was one failure during his tenure. Greenspan changed the subject, only – one suspects to Greenspan’s surprise – to be asked the same question again. He again ran off on a tangent. Maybe even Greenspan understood the emperor who wore no clothes had been exposed.

To those not suffering a bout of amnesia, his fidelity to the consumer was a surprise. That is, to those who have read the Greenspan Papers. We need only review transcripts of Federal Reserve Open Market Committee (FOMC) meetings in 2002. The man who built his reputation as a disciple of Ayn Rand (to be sure, a false claim) dearly wanted to drain the consumer of economic self-sufficiency. He succeeded.

The economy was emerging from recession, though imperceptibly. The mean household income declined in the United States every year from 2000 through 2004. To the Fed, consumer spending leads the economy. Since income from jobs was not boosting the GDP, innovative consumer finance was an FOMC obsession.

The Federal Reserve chairman spent the year not trying to protect consumers, but to bury them. At the March 2002 meeting, he stated: “[I]f the mortgage rate goes up, we will get some restraining effects on personal consumption expenditures because a goodly part of PCE has been financed by equity extraction from the appreciation in housing values.”

At 2002 meetings, Greenspan spent a good deal of time talking about consumers cashing out home equity from their houses and – it would only boost the GDP with the and – spending it. At the September FOMC meeting, Greenspan reported on the rising level of consumer cash from home sales and from cash-out refinancing.

First, from home sales: “We know, for example, that the current level of existing home turnover is quite brisk and that the average extraction of an existing home is well over $50,000. A substantial part of the equity extraction related to home sales, which is running at an annual rate close to $200 billion, is expended on personal consumption and home modernization, two components, of course, of GDP.” GDP growth, of course, is the Federal Reserve chairman’s popularity barometer.

Second, from refinancing extractions: “[A]pplications reported by the Mortgage Bankers Association [are showing] a very large increase in cash-outs. We estimate that they, too, are running in the $200 billion range at an annual rate, up very significantly from where they were a year or eighteen months ago.”

This was good news: “I think it’s fairly evident the unprecedented levels of equity extractions from homes have exerted a strong impetus on household spending.”

Also at the September meeting: “[T]here is no question that a goodly part of the robustness of household expenditures stems from [home equity cash outs]. Cars and light trucks which have been quite strong, are examples of large ticket items that are disproportionately purchased when equity is extracted from the sale of a home….”

In November, he thought “it’s hard to escape the conclusion that at some point our extraordinary housing boom and its carryover into very large extractions of equity, financed by very large increases in mortgage debt, cannot continue indefinitely into the future.” [Author’s italics.]

All to the good, as Edward Gramlich was told at the August meeting:

GRAMLICH: “I am just uncomfortable that the refinancing of housing should be the source of so much of the support for our recovery.”

GREENSPAN: “You sound like a true conservative.” So said the head banking regulator, responsible for the solvency of the banking system.

At the August 2002 meeting, Greenspan unrolled a theory, one that may actually work in the real world: the decline of interest rates plays an important role in trading, extracting and spending. (The Federal Reserve staff believed only the level of interest rates matter.) The chairman declared the “decline [in the 10-year Treasury yield] has had a major impact on thirty-year mortgage rates…. [W]e are seeing very significant churning in the mortgage markets, and as I have indicated previously, the increase in home equity is cumulative over a period of years because the prices of houses very rarely turn negative. What we are observing at this point is a very high rate of house turnover. Existing home sales are very high….”

This churning was as important as rising prices. A faster rate of house trading, multiplied by profits from house sales, prompted greater cash-out consumer spending.

At the November meeting, Greenspan once again pushed his decline-in-interest-rate theory: “In sum it strikes me that we are looking at an economy that potentially has significant upside momentum if it can get through the current soft spot. [M]y suggestion would be to lower the funds rate by 50 basis points – it is possible that such a move may be a mistake. But it’s a mistake that does not have very significant consequences.” The FOMC voted to cut the funds rate.

It might seem extraordinary, if we were not discussing Alan Greenspan, that the Federal Reserve chairman actively engaged in financial shenanigans with the specific intention of encumbering Americans with more debt at a time their incomes were falling.

The consequences today are most visible in Las Vegas, California’s Inland Empire and in southern Florida. As for Greenspan, the Fed had cut the funds rate 12 times in 2001 and 2002, from 6.5% to 1.25%. His theory was running out of ammunition. Greenspan’s manipulation of thirty-year fixed mortgage rates was nearly spent. (How does his 2002 theory square with his 2010 theory that short-term interest rates set by the Fed had no influence on the mortgage bubble?) By 2004 and 2005, he gave speeches exhorting Americans to buy adjustable-rate, interest-only and negative-amortizing mortgages.

The man never stops trying .

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply