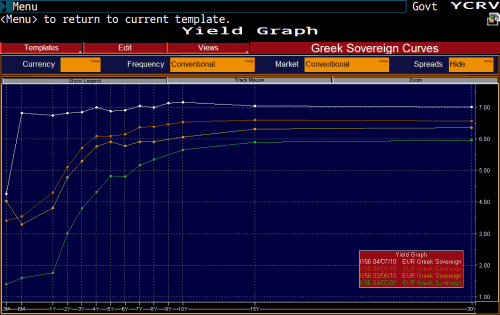

Big news this morning is Commerzbank pulling its repos that are supporting the Greek banks. These are overnight facilities, and may lead to runs on Greek banks. Unless someone steps in (IMF? IMF?) this should put the Greek banks into a liquidity meltdown. This chart from ZH shows the yield curve “pancaking” – going to flat – because the short term (3-6 month) rates have shot up, with spreads at an “all time record for a developed country.” This usually indicates a default coming.

ZH predicts:

- failed next bond auction for Greece

- Euro drops below $1.30

- Greece pushed out of EU

- Euro to $1.15

Update mid-day: ZH reports that Greek banks have now called the remaining E17B of a 2008 backstop plan. Deposits have dropped E8.4B since Dec. The Bundesbank may be also close to pulling its life-support backing. They need to fund E8.2B rolling over in Apr20, and E27B over the next seven weeks.Tomorrow the head of the ECB is expected to provide its plan for Greece Last chance before they swallow the bitter pill the IMF is offering?

Those contrarians among you may consider that if Greece accepts IMF’s tough terms, default will be avoided and these bonds will pay handsomely (since their rates will drop all the way back on a bailout).

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply