The Wall Street Journal reports:

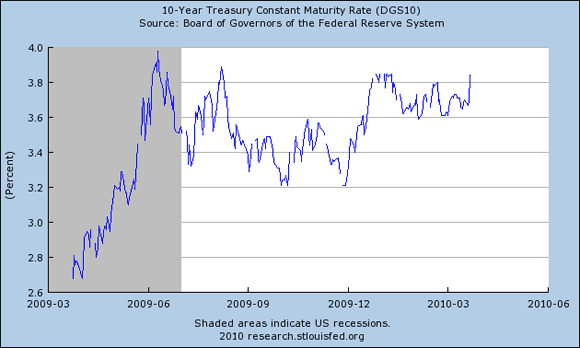

A sudden drop-off in investor demand for U.S. Treasury notes is raising questions about whether interest rates will finally begin a march higher– a climb that would jack up the government’s borrowing costs and spell trouble for the fragile housing market.

This week, some investors turned up their noses at three big U.S. Treasury offerings. Demand was weak for a $44 billion 2-year note auction on Tuesday, a $42 billion sale of 5-year debt on Wednesday and a $32 billion 7-year note sale Thursday.

The poor demand, especially from foreign investors, sent the bonds’ prices sharply lower and yields higher.

Paul Krugman (also here) and Brad DeLong are not concerned, noting we’ve seen lots of yield changes of this size or higher in the past.

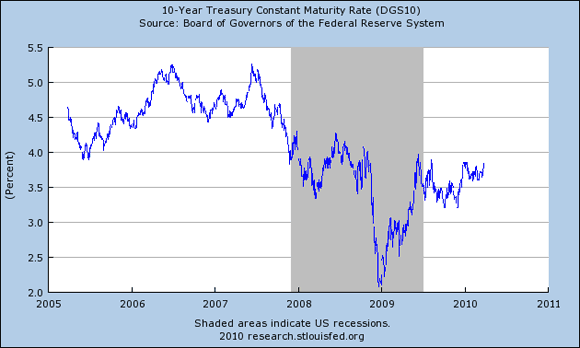

Even so, whether demand will continue to be there for burgeoning U.S. debt is obviously a question of great interest. Yields are now near the highest levels we’ve seen since the Lehman failure in September 2008, and if they continue to move up at their recent pace I wouldn’t want to dismiss it as an irrelevant development.

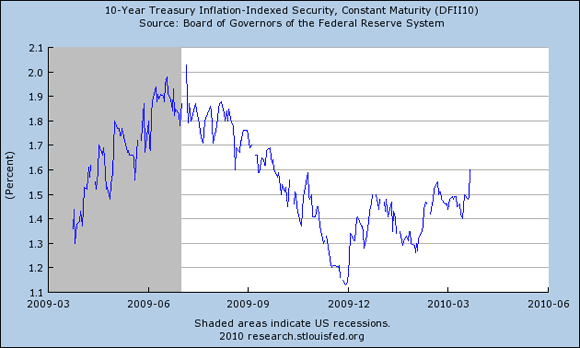

One possibility that I think we can rule out is that recent bond moves signal renewed worries about inflation. The recent surge in yields on Treasury Inflation Protected Securities is just as dramatic.

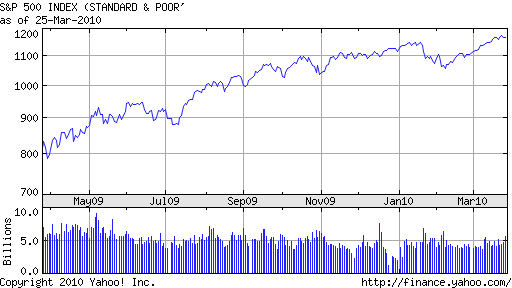

Also, if the WSJ explanation was the right one, I would have expected the increase in interest rates to depress stock prices. But stock prices have been going up along with bond yields.

When bond yields and stock prices rise together, I would usually read that as a signal of rising investor optimism about future real economic activity. The February numbers for home sales and other indicators that we’ve been receiving most recently don’t exactly support that thesis. Let’s hope that investors are correctly anticipating that better news lies ahead.

Charts: FRED, Yahoo Finance

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply