Last week, a post in the New York Times‘ Freakonomics blog on Okun’s law made note of the statistical discrepancy between the two methods for calculating national output:

“…there are two measures of output growth—the usual measure, which adds up total spending in the economy, and the alternative, which adds up total income. In theory, the two should be exactly the same. In practice, they have been very different during this recession… These GDI [gross domestic income] numbers suggest that output growth actually declined much more sharply than had been widely understood.”

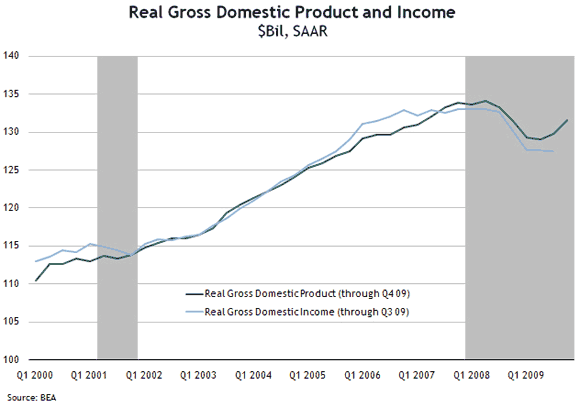

Indeed, the recession looks deeper and the recovery seems much less pronounced, looking at the income-side data in this chart.

There has been a good deal of coverage about the discrepancy between the income and expenditure sides of gross domestic product (GDP) calculations in the past couple of years. Jeremy Nalewaik, at the Federal Reserve Board, is often cited for his work arguing that GDI may be a more reliable measure for delineating recessions than GDP (see 1, 2, 3). In fall 2008, Jim Hamilton noted the relatively weak behavior of GDI toward the beginning of the current recession: “It is interesting that while GDP indicates sluggish growth over the last three quarters, GDI looks much more like a recession, with 2007:Q4–2008:Q1 satisfying the traditional rule of thumb of two quarters of falling real output.”

But apart from recession dating, how seriously should we take these income-side numbers?

One issue with using GDI data is that they lag the GDP data by a full quarter. That stated, a 2006 study by Fixler and Grimm at the Bureau of Economic Analysis (BEA) argues that GDI data contains valuable information.

“There is evidence that income-side measures contain information about revisions to estimates of GDP. National income is statistically significant in explaining revisions from the final current quarterly to the latest estimates of GDP. Conversely, there is no evidence that product-side measures contain information about revisions to GDI and national income.”

In other words, history suggests that when these two measures of national output disagree, GDP tends to get revised in the direction of GDI and not the other way around. So, if this relationship holds, it would be prudent not to dismiss the latest divergence in the two measures because it suggests that the decline in national output has been more protracted, and the recovery (through the third quarter 2009) more modest, than what is being reflected in GDP.

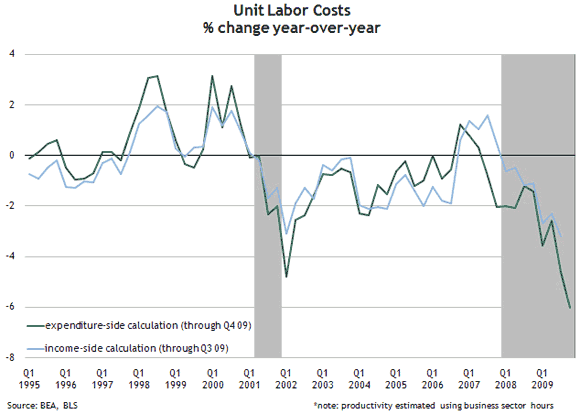

If true, this pattern could raise questions about current levels of productivity and associated labor cost measures. The decline in unit labor costs over the recession has been remarkable by either measure. But the recent drop in unit labor costs by way of the expenditure-side estimate was roughly 1.5 percentage points larger than the labor cost estimate that would be computed from the income side of the accounts. If revisions going forward continue to favor the income-side estimates, then maybe downward wage pressure—while probably still large—may be less than many believe.

By Laurel Graefe, senior economic research analyst, and Jacob Smith, quantitative research analysis specialist, both at the Atlanta Fed

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply