A new book by Kenneth Rogoff and Carmen Reinhart, “This Time It’s Different: Eight Centuries of Financial Follies“, has occasioned much comment in the press and blogosphere (see here and here).

The book purports to show that once the gross debt to GDP ratio crosses the threshold of 90%, economic growth slows dramatically.

But that’s too simplistic: Debt to GDP is a ratio and the ratio value is a function of both the numerator and denominator. The ratio can rise as a function of either an increase in debt or a decrease in GDP. So to blindly take a number, say, 90% debt to GDP as Rogoff and Reinhart have done in their recent work, is unduly simplistic. It appears that they looked at the ratio, assumed that its rise was due to an increase in debt, and then looked at GDP growth from that period forward assuming that weakness was caused by debt instead of that the rise in the ratio was caused by economic weakness. In other words, they have the causation backwards: Deficits go up as growth slows due to the automatic counter cyclical stabilizers.They don’t cause the slow down, etc.

As Randy Wray and Yeva Nersisyan have noted in a yet unpublished work, after the Second World War, the debt ratio came down rather rapidly-mostly not due to budget surpluses and debt retirement but rather due to rapid growth that raised the denominator of the debt ratio. By contrast, slower economic growth post 1973, accompanied by budget deficits, led to slow growth of the debt ratio until the Clinton boom (that saw growth return nearly to golden age rates) and budget surpluses lowered the ratio.

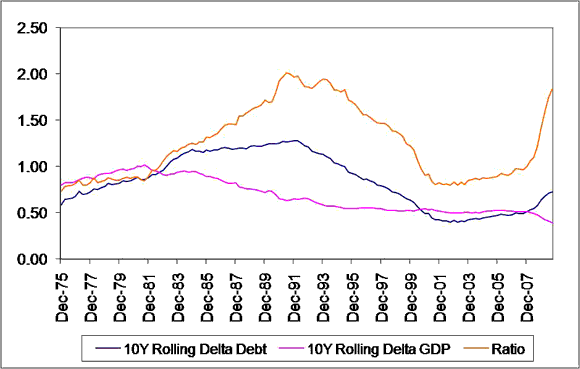

From 1991 through 2001 the growth of government debt had been falling and since then rising most recently at a faster pace. The raw data comes courtesy of the St. Louis Fed … (and attached spreadsheet).

The Ratio of the rates of change of Debt / GDP is rising faster than the change in Debt indicating that both the increase in Debt and the fall in GDP are contributing to a rising Debt / GDP ratio. For policy makers who obsess about a rising Debt / GDP ratio, they fail to understand that austerity measures that cut GDP growth will cause a rise in the Debt to GDP ratio. Basically, it boils down to this simple observation: it is foolish, dangerous, and thoroughly counterproductive to treat fiscal balances in isolation. In particular, setting a fiscal deficit to GDP target equal to expected long run real GDP growth in order to hold public debt/GDP ratios at a completely arbitrary (indeed, literally pulled out of thin air) public debt to GDP ratio without for a moment considering what the means for the feasible range of current account and domestic private sector financial balance is utterly nonsensensical.

It is crucial that investors and policy makers recognize and learn to think coherently about the connectedness of the financial balances before they demand what is being currently called fiscal sustainability. As it turns out, pursuing fiscal sustainability as it is currently defined will in all likelihood just lead many nations to further private sector debt destabilization. To put it bluntly, if the private sector continues to pursue a high net saving/financial surplus position while fiscal retrenchment is attempted, unless some other bloc of nations becomes large net importers (and the BRICs are surely not there yet), nominal GDP will fall in the fiscally “sound” nations, the designated fiscal deficit targets WILL NEVER BE ACHIEVED (there can also be a paradox of public thrift), and private debt distress will simply escalate.

In fact, if austerity measures are based on measures of debt relative to economic growth there is a very real risk of a downward spiral where economic growth declines at a faster pace than government debt and the rising Debt / GDP ratio leads to ever greater austerity measures. At a minimum, focusing only on the debt side of the equation risks increasing the Debt / GDP ratio that is the object of purported concern is likely to lead to policy incoherence and HIGHER levels of debt as GDP plunges. The solution is to recognize that the increase in the ratio is in some fair measure the result of declining economic growth and that only by increasing economic growth will the ratio be brought down. This may cause an initial rise in the ratio because of debt financing of fiscal stimulus but if positive economic growth is achieved the problem should be temporary. The alternative is to risk a debt deflationary spiral that will be much more difficult (and costly) to reverse.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply