Be prepared for a moment when technical analysis (TA) trumps fundamental analysis (FA): fundamentals say the Euro should weaken and the Dollar strengthen, but technicals say instead the opposite is due.

Big expose in the WSJ on how currency swaps and other off-balance-sheet tricks in Euroland allowed Greece cheat on the EMU (Euro) rules. (Swaps allow countries to accept liabilities for currency fluctuations that do not show up as current liabilities.) Of course Goldman Sachs structured these vehicles. That is what they are paid to do. Get mad at Greek leaders, not clever bankers.

Assuming a Greek rescue goes through, according to fundamentalists it will force the Euro to remain weak and allow the Dollar to strengthen:

Greece, along with Spain, Portugal and Italy, all need to increase taxes to reduce the deficit, and higher taxes in a recession reduces economic growth. Consequently the central banks will have to keep the liquidity high and the rates low. This means the US, with an anticipated quicker recovery, will be in a position to raise rates quicker than the eurozone bankers, goes the argument.

In contrast both Neely and today’s STU think the USD has completed a wave pattern and may have topped for the moment. If so, the Euro is about to have the strongest bounce in a while.

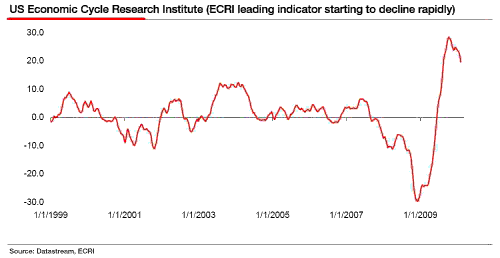

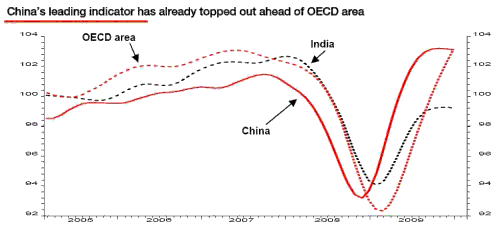

Later this week we will have an onslaught of Bernanke presumably to explain away the rate hike. He also may have to address weak Treasury auctions – another one today, where 30 year TIPS went out poorly. The yield came out 6 bp higher. Also markets are digesting the rolling over of ECRI’s leading indicators, as well as China’s. These are signs that the Fed may have to slow down its exit from QE, meaning it has to keep rates low.

In the race to the bottom of currencies, the turtle currency rises relative to the hare. While FA tsks tsks about the Euro, TA is signaling that regardless of exogenous forces, a USD drop is due. Later pundits can concoct the explanation that the US has to race a little faster over the next month to maintain Treasury auctions and deal with rate expectations even as the Euro hare struggles to figure out how to bail out the PIIGS without causing the internal politics of Germany & France to rebel against supporting their wastrel brethern in Club Med. Whew! Complex sentence. At least TA explanations are concise.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply