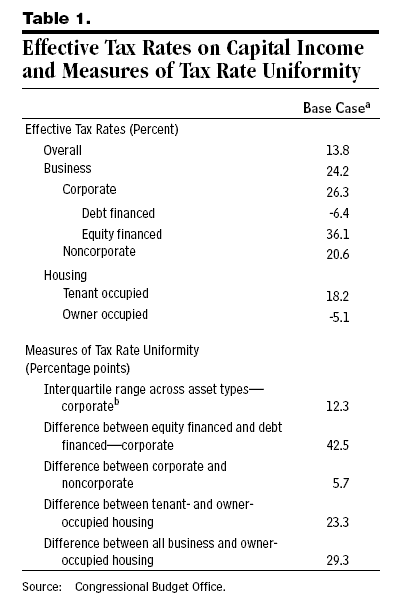

Washington invariably prefers the quick fix and ignores the underlying causes of whatever problem it faces. What better example than the financial crisis? At its most fundamental level, we underpriced the risk of mortgages and other financial assets. Why? President Obama and Congress have focused on the moral hazard of “too big to fail” financial institutions driven by bonus crazy CEOs making bets backed by government insurance. There’s plenty of truth in that, but the deeper cause was easy money. A month ago, I defended Ben Bernanke’s refutation of charges that the Fed’s 2004 to 2006 easy money policy was to blame. So if, Fed monetary policy wasn’t too easy, what was wrong? The corporate income tax deduction for interest produced a -6.4% tax rate on debt financed investments, while the double taxation of equity income (dividends and capital gains) produced a 36.1% tax on equity financed investments according to this 2005 Congressional Budget Office study. (See Table 1). That negative tax rate is the root of the fiscal crisis. Taxpayers paid a large subsidy for Wall Street investors to take those risks.

Washington invariably prefers the quick fix and ignores the underlying causes of whatever problem it faces. What better example than the financial crisis? At its most fundamental level, we underpriced the risk of mortgages and other financial assets. Why? President Obama and Congress have focused on the moral hazard of “too big to fail” financial institutions driven by bonus crazy CEOs making bets backed by government insurance. There’s plenty of truth in that, but the deeper cause was easy money. A month ago, I defended Ben Bernanke’s refutation of charges that the Fed’s 2004 to 2006 easy money policy was to blame. So if, Fed monetary policy wasn’t too easy, what was wrong? The corporate income tax deduction for interest produced a -6.4% tax rate on debt financed investments, while the double taxation of equity income (dividends and capital gains) produced a 36.1% tax on equity financed investments according to this 2005 Congressional Budget Office study. (See Table 1). That negative tax rate is the root of the fiscal crisis. Taxpayers paid a large subsidy for Wall Street investors to take those risks.

Marty Sullivan of Tax Notes (a former Joint Committee on Taxation economist) laid out the evidence very well on September 28, 2008. He showed how huge tax subsidies for mortgage interest and corporate interest expense fueled the Wall Street conflagration of 2007 and since. He also cites the warnings of the Joint Committee and Treasury of twenty years earlier. What politician is going to raise taxes on homeowners and on big financial institutions when times were good to avoid a financial crisis two decades later? No way! President Bush’s 2005 Advisory Panel on Federal Tax Reform made the same point, but it’s recommendations were ignored too.

On April 15, 2008, Brookings scholar Jason Furman (now Deputy Director of President Obama’s National Economic Council) made the same point before the Senate Finance Committee at the bottom of page 8 of his testimony. This New Yorker piece presents a well-written summary. Former Congressional Budget Office Director and McCain economic adviser Doug Holtz-Eakin made the same point on p.375 of this Tax Notes volume on October 23, 2006.

Yesterday, on NBC/s Meet the Press, former Treasury Secretary Hank Paulson called for tax reform to address “borrow[ing] too much” along with “too big to fail” regulatory reform, another recognition that our Tax Code is at the root of the financial crisis.

The hard part of tax reform is that you have to raise taxes on those getting the subsidies. There are far fewer of them than the many taxpayers who stand to get slightly lower tax rates, so Wall Street corporations will finance the lobbying to kill tax reform before it has to chance to prevent the next financial crisis. We’ll end up with watered down quick fixes at best, and the roots of the next financial crisis will remain in the Tax Code.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

“The corporate income tax deduction for interest produced a -6.4% tax rate on debt financed investments…”

Very well said!

Everybody knows that the purpose of policy is to change economic conditions. But nobody seems to notice that the changes we don’t like are often the result of policy.