Should the political influence of large financial institutions take some blame for the financial crisis? This column presents evidence that financial institutions lobbying on mortgage lending and securitisation issues were adopting riskier lending strategies. This contributed to the deterioration in credit quality and to the build-up of risks prior to the crisis.

Should the political influence of large financial institutions take some blame for the financial crisis? In his speech at the 2010 annual meeting of the American Economic Association, Fed Chairman Ben Bernanke argued that, based on evidence of declining lending standards during the boom, “stronger regulation and supervision aimed at problems with underwriting practices and lenders’ risk management would have been a more effective and surgical approach to constraining the housing bubble than a general increase in interest rates” (Bernanke 2010).

Why wasn’t financial regulation tightened before the crisis?

If regulatory action would have been an effective response to deteriorating lending standards, why didn’t the political process result in such an outcome? Questions about the political process, through which financial reforms are adopted, are very timely now that the US Congress is considering financial regulatory reform bills.

A recent study by Mian, Sufi and Trebbi (forthcoming) shows, for example, that constituent and special interests theories explain voting on key bills, such as the American Housing Rescue and Foreclosure Prevention Act of 2008 and the Emergency Economic Stabilization Act of 2008, that were passed as policy responses to the crisis.

A number of news articles have reported anecdotal evidence that, in the run up to the crisis, large financial institutions were strongly lobbying against certain proposed legal changes and prevented a tightening of regulations that might have contained reckless lending practices. For example, the Wall Street Journal reported on 31 December 2007 that Ameriquest Mortgage and Countrywide Financial spent millions of dollars in political donations, campaign contributions, and lobbying activities from 2002 through 2006 to defeat anti-predatory-lending legislation.

There has, however, been no careful statistical analysis backing claims that lobbying practices may have been related to lending standards. In a recent paper (Igan, Mishra and Tressel, 2009), we provide the first empirical analysis of the relationship between lobbying by US financial institutions and their lending behaviour in the run up to the crisis.

Data sources

Lobbyists in the US – often organised in special interest groups – can legally influence the policy formation process through two main channels.

- First, they offer campaign finance contributions, in particular through political action committees.

- Second, they lobby members of Congress and federal agencies about specific legislation.

In contrast to campaign contributions, these lobbying activities – which account for about 90% of expenditures on targeted political activity – have received scant attention in the academic literature.

The Lobbying Disclosure Act of 1995 requires lobbying firms and companies with in-house lobbying units to file reports of their lobbying expenditures with the Secretary of the Senate and the Clerk of the House of Representatives. Legislation requires the disclosure not only of the dollar amounts actually spent, but also the issues in relation to which the lobbying is carried out.

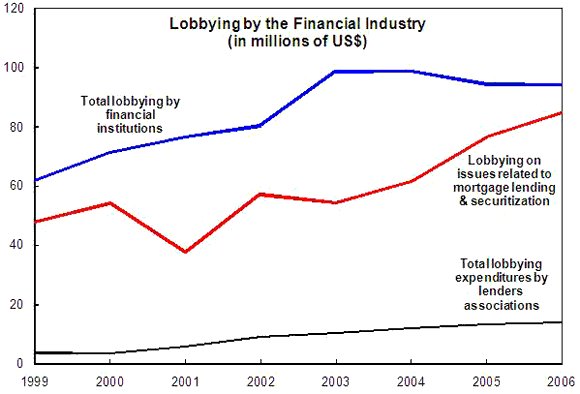

By going through individual lobbying reports, we identify all lobbying activities by financial institutions related to the regulation of mortgage lending and securitisation. During the period of the boom from 2000 to 2006, we find 16 pieces of federal legislation aimed at enhancing the regulation of predatory lending practices, none of which ever became law. The amounts spent on lobbying in relation to these laws were substantial and were spent mostly by large financial institutions.

The striking picture is that financial institutions lobbying on specific issues related to mortgage lending and securitisation adopted significantly riskier mortgage lending strategies in the run-up to the crisis.

We considered three measures of ex-ante loan characteristics: the loan-to-income ratio of mortgages, the proportion of mortgages securitised, and the growth rate of loans originated. The loan-to-income ratio measures whether a borrower can afford repaying a loan; as mortgage payments increase in proportion of income, servicing the loan becomes more difficult, and the probability of default increases. Recourse to securitisation is often considered to weaken monitoring incentives; hence, a higher proportion of mortgages securitised can be associated with lower credit standards. Fast expansion of credit could be associated with low lending standards if, for example, competitive pressures compel lenders to loosen lending standards in order to preserve market shares.

We find that, between 2000 and 2006, the lenders that lobbied most intensively to prevent a tightening of laws and regulations related to mortgage lending also:

- originated mortgages with higher loan-to-income ratios,

- increased their recourse to securitisation more rapidly than other lenders, and

- had faster-growing mortgage-loan portfolios.

These findings suggest that lobbying by financial institutions was a factor contributing to the deterioration in credit quality and contributed to the build-up of risks prior to the crisis.

Further results

Our study offers two pieces of evidence showing that lobbying lenders experienced worse performance once the financial crisis started.

- First, delinquency rates in 2008 were significantly higher in areas where mortgage lending by lobbying lenders had expanded relatively faster than mortgage lending by other lenders.

- Second, these lobbying lenders experienced negative abnormal returns around the key events of the crisis (such as the collapse of Lehman Brothers).

All in all, this evidence suggests that these lenders had larger exposures to poorly performing mortgage loan pools.

Conclusions and policy implications

What are the implications of these findings for policy making?

- Should lobbying be banned altogether because it is driven by rent-seeking?

- Is lobbying symptomatic of other underlying problems?

- Is lobbying, on the contrary, a channel through which lenders share their private information with policymakers?

With the benefit of hindsight, it seems reasonable to argue that lobbying by financial institutions can contribute to risk accumulation and threaten the stability of the financial system. Drawing precise policy implications, however, may not be straightforward, and would depend on the motives behind lobbying and lending practices.

Financial institutions may lobby to obtain private benefits, such as decreased scrutiny by bank supervisors, or higher likelihood of a bailout, and potentially under less stringent conditions. Under such rent-seeking motivations, lobbying is socially undesirable, all the more so as it contributes to financial instability. It should therefore be tightly regulated.

Lobbying may also reflect distorted short-term incentives within financial institutions; the perspective of high short-term gains may motivate both risk taking and lobbying. In this case, tackling the underlying distortion – by aligning managers’ compensation with long-term profit maximisation – may be a more efficient way to limit excessive risk-taking than preventing lobbying.

More optimistically, financial institutions may also lobby to reveal superior information on the mortgage lending market and gain support for innovation in financial services. In this view, lobbying serves a social purpose, and there may be better ways to contain risks than simply challenge lobbying.

The ongoing legislative efforts to enhance banking supervision and regulation in the US provide another context to further our understanding of the motivation for lobbying by the financial sector. Recent reports show that financial institutions intensified their lobbying efforts in 2009 to fight against an overhaul of derivatives regulation and legislation. Johnson (2009) argues that substantial reform will fail unless the political power of the finance industry is weakened. Further work will be needed to ascertain whether this will be the case.

References

•Bernanke, Ben (2010), “Monetary Policy and the Housing Bubble”, Speech at the Annual Meeting of the American Economic Association, Atlanta, 3 January.

•Igan, Deniz, Prachi Mishra, and Thierry Tressel (2009), “A Fistful of Dollars: Lobbying and the Financial Crisis”, IMF Working Paper 09/287.

•Johnson, Simon (2009), “The Quiet Coup”, The Atlantic, May.

•Mian, Atif, Amir Sufi, and Francesco Trebbi (forthcoming), “The Political Economy of the US Mortgage Default Crisis”, American Economic Review.

•Simpson, Glenn R (2007), “Lender Lobbying Blitz Abetted Mortgage Mess”, The Wall Street Journal, 31 December.

![]()

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply