There must be more than a few people humming the old Clash tune with regularity these days. Not that there’s anything wrong with that- it might be Macro Man’s second favorite Clash tune after London Calling- but consider the following:

Bankers, hedge fund/private equity managers, and similar “leeches on society.” In both the US and UK, people in our industry fall somewhere below “open vats of raw sewage on a hot day” in terms of popularity and garnering public sympathy. While the public’s anger is certainly understandable, it doesn’t mean that it is universally justified, as there appears to be little distinction drawn between those who necessitated a bailout, those who benefited indirectly from bailouts/easy liquidity, and those who have just gotten on with things and would have been successful regardless of circumstance.

The increasingly onerous tax/regulatory regimes being put in place (little looks set to change after the UK election) must have a number of people and firms looking longingly at more finance-friendly regimes, be they in Switzerland, Asia, or even Canada. (Those who wish to respond “good riddance!”, “we’re happy to do without you”, and “don’t let the screen door hit you in the ass on your way out!” should consider their viewpoints pre-emptively noted and thus not necessary to re-post.)

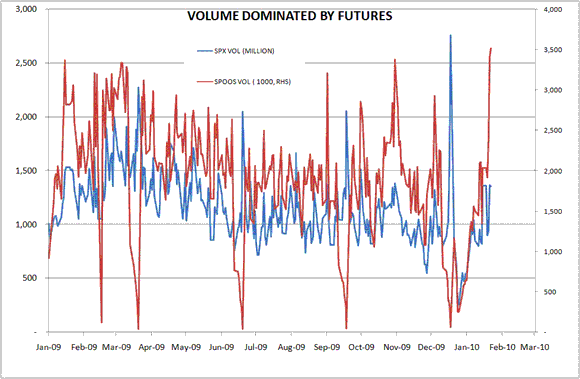

Equity longs. What a long strange trip it’s been for stocks, but per the posts of the last week or so, it feels as if a sea change has taken place. The reaction to earnings, China, Greece, and Obama has been underwhelming, to say the least, and price action suggests that we are now in liquidation mode. Thus far, however, the downmove has largely been a speculative or at least futures-driven phenomenon. E-mini’s generated their two largest volume days since 2008 on Thursday and Friday, while cash volumes, though decent, were nowhere near that kind of extreme.

The key question for equities in what could prove to be a tumultuous week is whether individual stock holdings begin to see more forceful liquidation, or whether futures shorts get squeezed. If the sea change theory is right, it will be the former and long holdings will go.

Ben Bernanke. Ah, Ben. While most assumed that he his confirmation for a second term as Fed Chairman was a foregone conclusion, over the past 72 hours his fate has been the hottest of hot topics. Over the weekend Macro Man received a flurry of emails on the subject, with Saturday’s basically saying “he’s toast” while those of the past 24 hours suggest that he may be able to stick around after all.

His term expires on January 31, which means that the issue really ought to be be resolved this week (though it won’t necessarily be. He will remain a Fed governor and can act as de facto chairman if the vote doesn’t occur.) Still, it makes this week’s FOMC meeting extra spicy (though no real change is expected) and should provide an interesting gauge of just how much pressure Congress is feeling from its constituents. (As an aside, Tim Geithner is probably humming the tune as well. He must feel Volcker [literally] breathing over his shoulder….)

One could extend the analogy even further, to Greece (should I stay in the euro or should I go) and China (should I stay rigidly pegged to the USD, or should I let the RMB go?) Macro Man will save those analysis for another time…

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply