Joseph Lawler at the Spectator distills the Austrian perspective on the sources of current unemployment.

Economists of a statist or Keynesian bent tend to posit that modern managers are quicker to fire employees and squeeze extra productivity out of their remaining workers, and then explore why that might be so. …

There is a more compelling, more market-based explanation that borrows insights from Austrian-style economists like Joseph Schumpeter and Chicago business cycle theorists like Fischer Black. It focuses on the changes that the modern labor market has undergone, and explores the possibility that recessions now cause structural, as opposed to cyclical, changes in hiring. Cyclical changes are responses to the business cycle: companies across all industries tighten their belts and start laying off employees when austerity threatens, but then rehire the workers they laid off when good times roll again.

A structural change in the labor market, on the other hand, occurs when hiring patterns change not as a function of economic fluctuations, but because of shifts in the economy’s production that reallocate workers among industries. In other words, a mismatch between what consumers demand and what producers are making necessitates a shake-up in the mix of industries. Perhaps the most familiar example of a structural change is the Industrial Revolution, when, starting in the 18th century, Great Britain’s labor force transitioned from manual labor to machine-aided manufacturing jobs in great numbers.

I’ve been teaching intermediate macroeconomics for some twenty years. While it’s true that a distinction has typically been made between frictional, structural and cyclical unemployment in the textbooks, since at least the hysteresis literature of the 1980’s, there’s been an understanding that aggregate demand shocks can induce long lasting and persistent unemployment. Hence, the distinction between the mainstream view (as taught in advanced macro textbooks) and this Austrian view is, I think, a bit overdrawn.

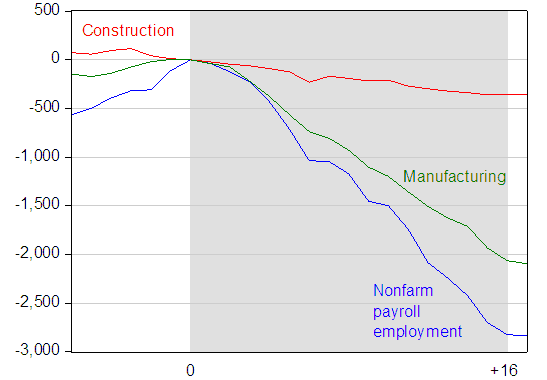

But Mr. Lawler’s assertion did impel me to take a look at the data, to see at a gross level how big the structural changes might be in the two examples cited in the article, namely construction and manufacturing. Here’s a breakdown of total payroll employment change relative to NBER defined peak (blue), as well as construction (red) and manufacturing (green).

Figure 1: Change in employment, in 000’s, relative to NBER defined peak. NBER defined recession dates shaded gray. Source: BLS November 2009 release, via FRED II, and NBER.

There was a big change particularly in manufacturing, suggestive of big structural shifts. Interestingly, these data are for the 1981-1982 recession, the last big recession before the last two “jobless recoveries”. Below is the analogous graph for the current recession.

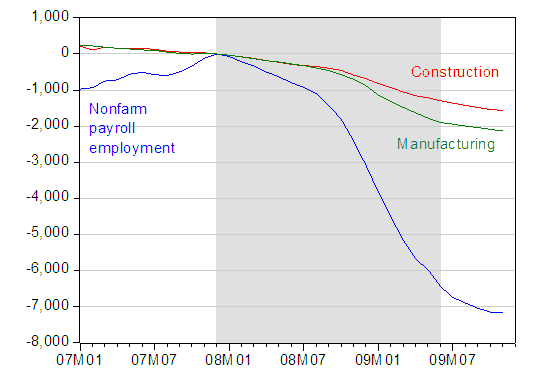

Figure 2: Change in employment, in 000s, relative to NBER defined peak. NBER defined recession dates shaded gray, assuming trough at 2009M06. Source: BLS November 2009 release, via FRED II, and NBER.

(Note the change of scales.) This argument is explicitly not to deny that structural shifts are important (part of the decline in potential growth that is likely to occur will be due to these mismatches, as I’ve discussed before [1]). But I do wonder about the assertion that the structural shift is the major component of the unemployment currently observed — Valletta and Cleary (2009) provide a skeptical look). Is there a stylized fact that indeed “…modern technologically advanced firms do a better job calculating their optimal amount of labor without resorting to temporary layoffs — if they downsize, they downsize permanently because their industry is shrinking.” Something like this phenomenon should show up in volatility data at the micro level, I would suppose as higher volatility. As Davis and Kahn note in their survey of the Great Moderation, the data are not supportive of this conjecture.

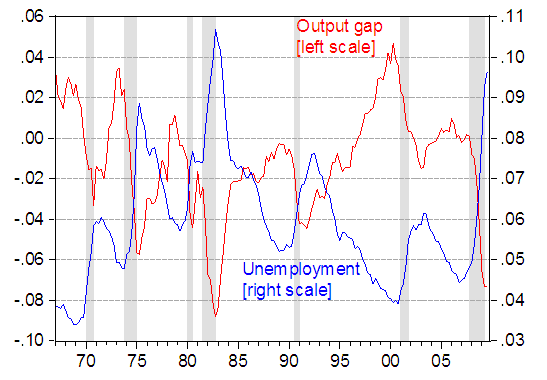

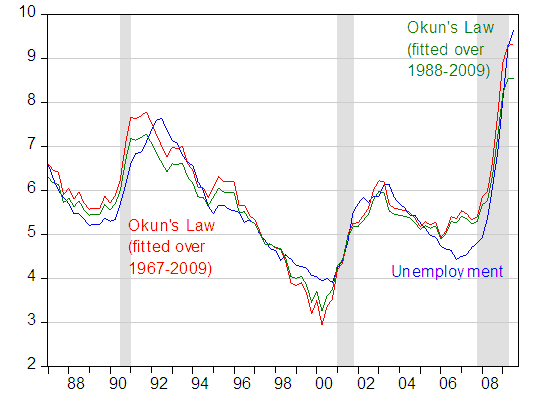

Another interesting assertion that Mr. Lawler makes in support of the re-allocation thesis is that Okun’s law fails to predict the current level of unemployment. In Figure 3, I show the output gap and unemployment rate, and in Figure 4, the implied unemployment rate using the regressions estimated over the 1967-09 and 1967-88 periods. (Of course, there are different Okun’s laws, including those using payroll employment, and in first differences, as I noted in this post).

Figure 3: Output gap in log terms (red, left scale) and unemployment rate, quarterly average of monthly data (blue, right scale). NBER defined recession dates shaded gray, assumes last recession ended 09Q2. Source: BEA, 09Q3 3rd release, CBO January 2009 estimate of potential, rescaled by 1.14 to convert to Ch.2005$, BLS via FRED II, NBER.

Figure 4: Actual unemployment rate (blue), and fitted values using 1967-09 regression (red) and using 1988-2009 (green). Source: BLS via FRED II, NBER, and author’s calculations.

What I find interesting is that if one uses the last two decades to estimate Okun’s law (in levels), one does find underprediction by about a percentage point, and indeed the actual outcome for 2009Q3 is statistically significantly different from the predicted value. However, if one uses the entire 1967-09 sample (which is consistent with the view that the current recession is due to a mixture of deficient aggregate demand and changes to the composition of demand), then the misprediction is minimal in both economic (a third of a percentage point) and statistical terms.

To summarize: secular structural unemployment is likely to have risen. But it is not clear to me that an increase in structural unemployment constitutes the largest portion of the increase in unemployment. If a large negative aggregate demand shock explains a large portion of the negative output gap, then the Okun’s law coefficient over a longer sample may be more relevant. This conclusion does not deny the fact that unemployment rates may remain elevated, since the output gap is likely to be negative for an extended period of time. The big difference is with respect to policy prescriptions. The Lawler interpretation suggests macrostabilization policy (read monetary and fiscal policy) is worse than useless. A different interpretation, ascribing substantial import to deficient aggregate demand, suggests that monetary and fiscal policies in support of aggregate economic activity is a useful endeavor.

How Important Is Structural Unemployment in the Current Recession/Recovery?

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply