The purpose of a cap-and-trade system is to help in the fight against global climate change. This column warns that a unilateral approach could increase global emissions by shifting production to more carbon-intensive methods abroad. Acting alone, the EU’s Emission Trading Scheme may be doing more harm than good.

The purpose of a cap-and-trade system is to help in the fight against global climate change by putting a cap on domestic emissions. It is clear that a binding cap on emissions will restrict the supply of all energy-intensive goods. This implies that the global price of these goods must increase, and therefore production abroad will increase, which will lead to higher emissions abroad. A carbon tax will have the same effect, which is called “carbon leakage” in the parlance of the climate change community.

Most existing analysis of carbon leakage focuses on a small subset of energy-intensive sectors (steel, cement, etc.) whose products are often traded intensively. The EU has actually defined sectors exposed to a significant risk of carbon leakage mainly in terms of their openness to trade and found that about 60% of all Emission Trading Scheme sectors (accounting for about 75% of emissions) are “at risk” (see Appendix).

A recent study based on a large general-equilibrium model concludes that about 40% of any reduction in the production of energy-intensive goods in the EU would be offset by higher production abroad (Veenendaal and Manders 2008).¹

A cap-and-trade paradox

In recent work, I argue that this focus in much of the literature on energy-intensive industries is misguided because it focuses on the wrong issue (competitiveness of particular sectors) and neglects the fact that the output of these industries (especially energy and steel) is used throughout the economy (Gros 2009). Most products that are traded intensively incorporate thus substantial amounts of emissions via the energy and energy-intensive inputs used in their production. Given that it is usually assumed that the supply of exports from China and other emerging market economies is rather price elastic, even small changes in relative prices could have a considerable impact on trade flows.

It is well known that carbon leakage undermines the effectiveness of any national cap- and-trade system in reducing global emissions. But it is not widely realised that, under certain conditions, carbon leakage could paradoxically cause the imposition of a cap-and trade–system like the Emission Trading Scheme to increase global emissions and thus reduce (global) welfare.

The mechanism through which this can happen becomes clear once one distinguishes between production and carbon leakage.

- “Production” describes the displacement, at least partially, of domestic production to the rest of the world.

- “Leakage” refers to the amount of emissions avoided when domestic production falls relative to the increase of emissions in the rest of the world where production goes up.

For example, if production leakage were only 50% (i.e. foreign production increases only by one half of the fall in domestic production), global emissions would still increase if the carbon intensity abroad is more than twice as high as at home. The general point is that the displacement of production, even if partial, can lead to an increase in overall emissions if the carbon intensity of production in the rest of the world is much higher than at home.

Differences in carbon intensity

A key parameter in any judgement of the efficiency of the Emission Trading Scheme (and the national carbon taxes in France and Sweden) is thus the difference in carbon intensity between the EU and its major trading partners. How large is it?

Estimates of the emissions embodied in international trade have to be based on input-output matrices in order to taken into account the way energy inputs are used throughout the economy. On this basis Weber et al. (2008) suggest that (on average for all sectors) each $1000 of exports from China contains about 2-3 tonnes of carbon, about 4 times more than the 0.5 tonnes of carbon embodied in $1000 of exports from the EU or other OECD countries. The same sources also show that exports from other emerging markets have sometimes even higher carbon intensities than those of China.

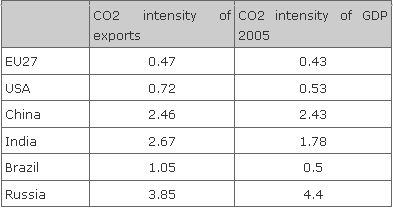

Another way to provide a crude estimate of differences in carbon intensities is the carbon intensity of GDP, which is ten times higher in Russia than in the EU and six times higher in China (see Table 1). Of course, the higher carbon intensities of emerging markets are partially due to their different output mix. However, this does not change the basic fact that a dollar unit increase in exports from China in general embodies four times as much CO2 emissions than a dollar of exports from the EU or the US. Moreover, higher exports in general lead to higher income, and higher GDP growth in China is associated with a very higher growth rate of emissions.

Table 1. Countries’ carbon intensities

Source: Author’s calculations based on IFM data and Weber et al. (2008). Carbon intensity of exports is based on 2002 data. Both intensities are measured as tons of carbon per 1000 dollars.

If one accepts as a benchmark that Chinese production is in general about 4 to 5 times as carbon-intensive as that of the EU, it follows that the Emission Trading Scheme might have led to an increase in global emissions if production leakage had been only somewhat above 20-25%.²

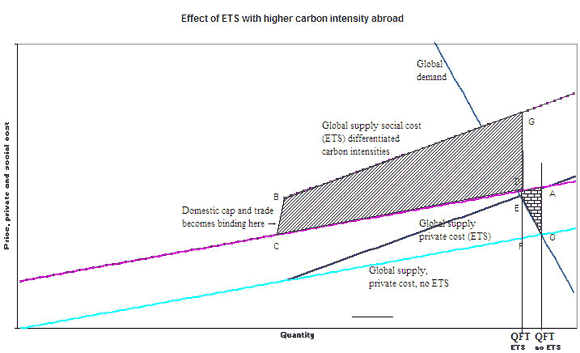

A proper welfare evaluation of the economic impact of a cap–and-trade system like the Emission Trading Scheme (or of the more wide-ranging recent French proposal to tax all energy inputs, not only in the energy-intensive (Emission Trading Scheme) sectors) should take into account also the fact that the displacement of consumption and production leads to standard welfare effects (producer and consumer surpluses). Figure 1 shows the equilibrium conditions for a (possibly composite) good whose production creates emissions and thus an externality.

Figure1. Effect of Emission Trading Scheme with higher carbon intensity abroad

The introduction of a domestic carbon price (via a ‘cap and trade’ system or otherwise) has two effects:

- It reduces global production, from QFTno ETS to QFTETS.

This reduction in global production increases welfare because at the margin the social cost was higher than the (private=social) benefits from consumption. The net welfare gain is given by the area (covered by little rectangles) enclosed by the points OADE (loss of consumer surplus under the line OE but gain of social cost of production below the line DG).

- The fact that the domestic price of carbon is higher than the price for carbon abroad leads to an increase in the social cost of production beyond the point at which the domestic “cap” or ceiling is reached.

From this point onwards, the social cost is not only above the one for the unconstrained case (i.e. the case without a domestic cap on emissions) but also steeper because any additional production has to take place abroad. This increases the social cost for two reasons: first, the private cost of production is higher because the supply from domestic producers cannot increase. Secondly, the external effects from producing abroad are higher because the carbon intensity abroad is higher. This implies that the (global) social cost of producing the reduced quantity QFTETS is higher by the shaded trapezoid enclosed by the points BCDG.

As drawn, it is clear that an ETS-like cap–and-trade system can actually make the world worse off. Whether or not this is the case depends of course on the slopes of the demand and supply functions relative to the difference between domestic and foreign carbon intensities.

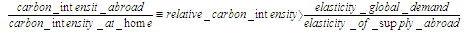

Gros (2009) shows in the context of a standard fully specified model that a domestic price on carbon can be counterproductive in terms of global welfare under the following condition:

This condition is more likely to be satisfied the lower the sum of the domestic and foreign elasticities of demand and the higher the foreign elasticity of supply, adjusted for the size of the foreign country. In other words, the introduction of a cap-and-trade system in a small country that is much less carbon-intensive than the rest of the world has a high probability of being counterproductive. Moreover, the longer the time horizon, the higher should be the elasticity of supply. This implies that while carbon leakage might not be important in the short run, it could become much more relevant as time goes on.

This analysis would of course be relevant, mutatis mutandis, also for the general carbon tax recently proposed in France. Given that France is small relative to the rest of the world and that the carbon intensity of the French economy is rather low, this measure could thus very well have a negative impact on global welfare. Adopting a domestic carbon tax at the EU level would not change the conclusion much since the EU accounts also for only a limited share of global GDP.

Conclusion

Given that the developing world has now openly declared that it is not willing to accept any binding cap on its own emissions at the Copenhagen summit, it is time to rethink the European approach to combating climate change. The unilateral approach followed so far might do more harm than good. In my next column, I will outline a unilateral approach that will benefit the environment with certainty.

References

•Gros, Daniel (2009), “Global Welfare Implications of Carbon Border Taxes“, CEPS Working Document No. 315/July.

•Gurria, Angel (2009), “Carbon has no place in global trade rules”, Financial Times, November 4 2009.

•Renaud, Julia (2008), “Issues Behind Competitiveness and Carbon Leakage, Focus on Heavy Industry”, International Energy Agency, October.

•Tirole, Jean (2009a), “Politique climatique: une nouvelle architecture internationale”, Conseil d’Analyse économique.

•Tirole, Jean (2009b), “Climate change negotiations: Time to reconsider“, VoxEU.org, 16 November.

•Veenendaal, P. and T. Manders (2008), “Border tax adjustment and the EU-ETS, a quantitative assessment”, CPB Document No. 171, Central Planning Bureau, The Hague.

•Weber, Christopher L., Glen Peters, Dabo Guan and Klaus Hubacek (2008), “The contribution of Chinese exports to climate change”, Energy Policy, Vol. 36, No. 9, pp. 3572-3577.

◊◊◊◊◊◊

Appendix

Article 10a of the revised Directive states that a sector or sub-sector is “deemed to be exposed to a significant risk of carbon leakage if:

- the extent to which the sum of direct and indirect additional costs induced by the implementation of this directive would lead to a substantial increase of production cost, calculated as a proportion of the Gross Value Added, of at least 5%; and

- the Non-EU Trade intensity defined as the ratio between total of value of exports to non EU + value of imports from non-EU and the total market size for the Community (annual turnover plus total imports) is above 10%.” A sector or sub-sector is also deemed to be exposed to a significant risk of carbon leakage:

- if the sum of direct and indirect additional costs induced by the implementation of this directive would lead to a particularly high increase of production cost, calculated as a proportion of the Gross Value Added, of at least 30%; or

- if the Non-EU Trade intensity defined as the ratio between total of value of exports to non EU + value of imports from non-EU and the total market size for the Community (annual turnover plus total imports) is above 30%. See: http://ec.europa.eu/environment/climat/emission/carbon_en.htm which concludes: 151 of 258 NACE-4 sectors (≈ 60% of all sectors) deemed at Significant Risk of CL (SRCL). Sectors deemed exposed to SRCL account for ≈ 75% of GHG emissions of industries covered by ETS.

¹ This study arrives, however, at much lower estimates for overall carbon leakage for reasons that are not clear. See also Renaud (2008). For a different point of view see Gurria (2009).

² It is of course impossible to determine the marginal carbon intensity for exports from emerging economies that are related to the imposition of the Emission Trading Scheme in Europe. However, the burden of proof should be on those who argue that this marginal carbon intensity is much lower than the average measured by aggregate statistics.

![]()

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply