There is an ongoing debate on whether we will see inflation or deflation during the coming years. Inflation could be a result of the expansionary monetary policies we have witnessed in many countries around the world. Deflation could be caused by the effects of the economic slowdown (asset price deflation, deleveraging, low growth) and its global nature.

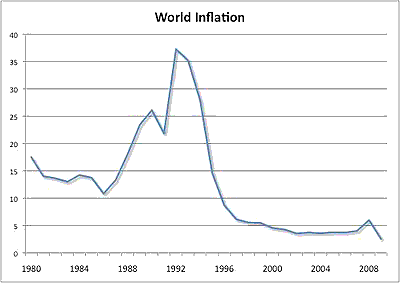

Despite these concerns, inflation indicators remain very stable. After a period where they were pointing in the direction of deflation, they are now back to levels which are fairly consistent with inflation in recent years. The stability of inflation forecasts and how they seem to be ignoring some of the theories that suggest more radical changes ahead are a reflection of the strong anchoring of inflation expectations that has been achieved in recent decades. This anchoring of expectations is the result of very low and stable inflation in most economies since the mid 90s. Here is the evolution of World inflation since 1980 (source: IMF World Economic Outlook database October 2009).

It is remarkable how after 1996 inflation has remained almost constant. While it is true that this was a stable period of time from an economic point of view, there were several episodes (the Asian crisis, the recession in 2001/2002) that could have had an effect in inflation. The fact that inflation did not react and remained in a very narrow range (between 4-5%) is behind the strong anchoring of inflation expectations. And this is a virtuous cycle: the more anchored inflation expectations are, the more stable inflation will be.

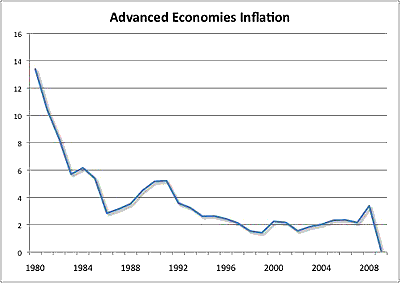

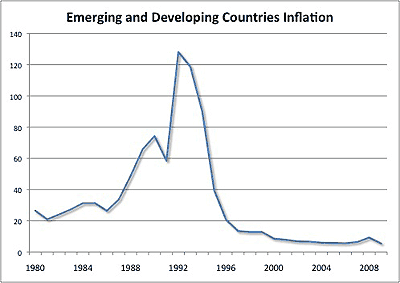

What is also interesting is to see that the behavior of inflation has been very similar across developed and developing countries. In the case of advanced economies, inflation decreased very fast in the early 80s and came down even more in the mid-90s. In the case of emerging markets we witnessed a period of high inflation during the early 90s but after 1995 inflation has come down and remained stable for 13 years.

While 13 years of stable inflation cannot guarantee that we will not see large changes in the inflation rate in the coming years, there is no doubt that this is a reflection of the strong anchoring of inflation expectations, more so than in any other period in recent history and this stability is likely to keep inflation volatility low even in the presence of many uncertainties.

Unfortunately for your analysis, the government is liquidating, which means demand collapses. Government is the party to 50% of transactions in the U.S.–it is the glue which keeps the economy together. The liquidation by government of its position in the society, means that deflation, not steady prices at any level. The best measure of demand collapse is supply chain deterioration, which is now occurring. Watch for it happening in agriculture.

The so-called “stimulus” is simply looting, which is exactly what Mellon was talking about when he advised Hoover; Roosevelt continued this looting. The “stimulus” is the rich dragging every last nickel it can out of the society before circling the wagons. This is why there will be another stimulus bill, probably about $2.5 trillion, probably around February 2010. There is still a lot of wealth in the U.S. for the rich to steal.

They will steal it ALL.