UCSD Ph.D. candidate Sam Dastrup has completed a very interesting study with his advisor Professor Richard Carson of what accounts for differences across U.S. communities in the magnitude of the decline in real estate prices that we’ve seen over the last several years.

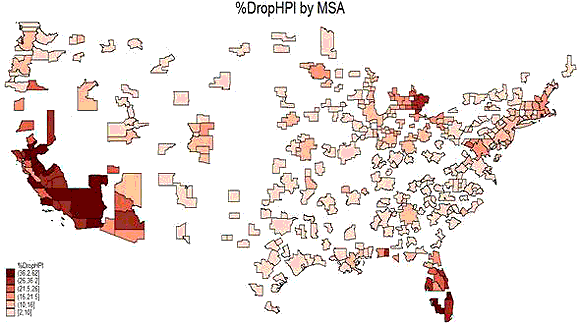

Although many commentators write as if there were a national housing market, there have been huge differences in the experience across communities. Dastrup and Carson examine the OFHEO matched-sale data for house prices as calculated separately for 358 U.S. standard metropolitan statistical areas. As seen in the map below, the magnitude of the price decline has differed greatly across U.S. communities, with the biggest drops in the southwest, Florida, and Michigan.

Magnitude of house price declines for 358 SMSAs. Source: Carson and Dastrup (2009).

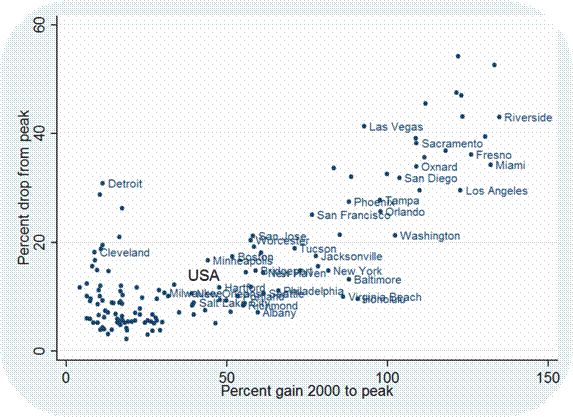

Dastrup and Carson look at how the magnitudes of the price declines correlate with a number of other community characteristics such as overbuilding (as measured by growth in building permits relative to the local labor force), extent of subprime lending, owner-occupied units, and fundamentals such as median income. Dastrup and Carson find that all of these measures were statistically significantly related to the magnitude of the housing price decline. But by far the most important variable was the magnitude of the previous price run-up, which all by itself can account for more than half of the observed variance in the size of the price decline across different communities.

Magnitude of house price increase prior to peak (horizontal axis) versus magnitude of house price decline (vertical axis). Source: Carson and Dastrup (2009).

I see this as consistent with earlier research by Marco Del Negro and Christopher Otrok which documented a common national factor driving much of the U.S. housing price boom, which in the Del Negro-Ostrok specification was allowed to affect different communities with different coefficients. My understanding of what happened is that low interest rates and in particular a deterioration of underwriting standards fueled an increase in housing demand everywhere in the earlier part of this decade. The magnitude of the price increase that this produced differed across communities as a function of local conditions. When these aggregate factors reversed, so did the prices.

The more prices were artificially bid up, the more spectacularly they declined.

Postscript to potential employers: Sam’s a great teacher, and looking for a job.

Factors in local house price declines

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply