We’ve been talking a lot about the Fed lately so I thought I’d share my version of the Taylor Rule calculation. I’ve built this myself so it might not exactly track other versions that are out there, but I did follow Taylor’s basic methodology. Bear in mind that this isn’t meant to predict Fed Funds. I use it more as a reality check. If my Taylor Rule calculation is falling I’m not likely to make a call that Fed Funds is going to be rising.

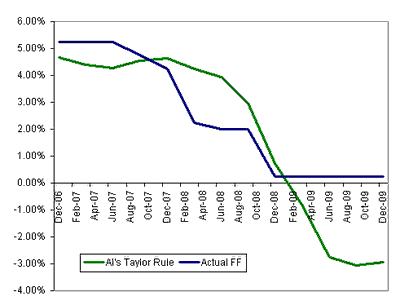

Anyway, here is a recent chart of the output. Taylor Rule in green, actual Fed Funds target in blue. I took it out to 4Q 2009 assuming that 4Q GDP and CPI comes in equal to Bloomberg’s economist survey (3%).

Holy liquidity trap Batman! Its sharply negative, suggesting that monetary policy can’t get easy enough. Thus it justifies the Fed’s current stance.

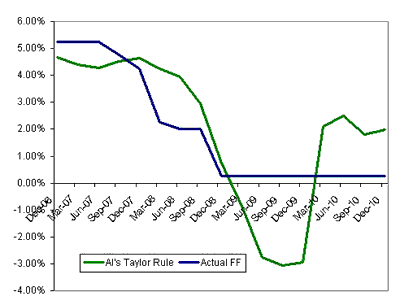

Now consider what it looks like if I carry out the Bloomberg median survey result for both GDP and CPI through 2010.

Suddenly the “correct” Fed Funds level according to my model is 2%, by the first quarter! Will the Fed actually hike by 200bps between now and 1Q 2010? Even assuming that GDP comes in as expected in 1Q, I highly doubt the Fed gets this aggressive. But could they start hiking? I think its possible.

I think readers should consider the following:

- Potential GDP is probably falling due to a less levered economy. That means a lower level of GDP would be considered above potential and thus potentially inflationary. It probably also means a higher level of NAIRU.

- There is room to remain accommodative in policy but be above zero on Fed Funds target.

- The fact that we’re far below trend GDP levels doesn’t matter. In a Keynesian world, its a question of whether Aggregate Demand is outpacing Aggregate Supply. What Aggregate Demand would have been in 2006 isn’t relevant.

- As a trade, if GDP does improve but the Fed doesn’t hike at all, then it will be time to put on a bear steepener!

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply