Global imbalances are shrinking at a fabulous rate. This column argues that these improvements are mostly illusory – the transitory side-effect of the greatest trade collapse the world has ever seen. A global recovery will almost surely return the US, Germany, China and others to their old paths.

They are blamed for the global crisis directly (Paulson 2008) or indirectly (Calvo 2009), G20 leaders are committed to ending them, and commentators have generated an ocean of html painting them as one of the world’s greatest banes. “They” are global imbalances – large trade surpluses and large trade deficits.

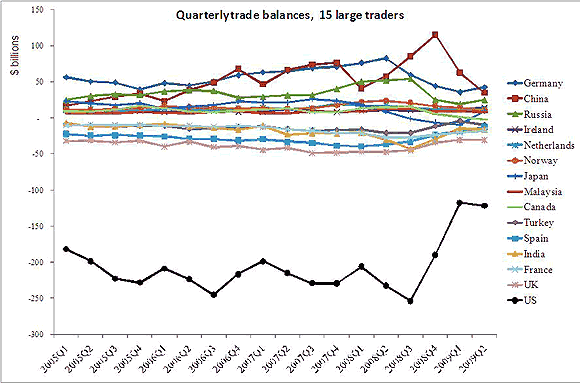

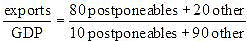

Good news then – global imbalances have been shrinking at a fabulous rate (Figure 1).

Figure 1. Shrinking global imbalances, 2007-2008

Source: WTO Quarterly merchandise trade data

The figure – which includes China, Germany, the US and all the other usual suspects in the global-imbalances saga – shows that trade gaps have closed remarkably quickly since late 2008. The IMF and World Bank both forecast substantial improvements for 2009 and into 2010 (IMF 2009 and World Bank 2009a). The World Bank, for instance, predicts that China’s surplus in 2010 will be half its 2008 value.

This rapid improvement seems odd given how little reform has occurred. The renminbi has not appreciated against the dollar and Chinese consumption has not boomed; the dollar has depreciated modestly against European currencies and the US savings rate has risen gently, but neither seems large enough to account for the massive shifts already observed, to say nothing of the World Bank predictions for future improvements.

We argue here that these global imbalance improvements are mostly illusory – the transitory side effect of the greatest trade collapse the world has ever seen. Before making the argument, we lay out the basic facts.

The trade collapse

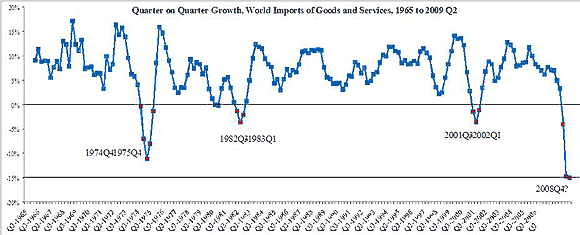

Since late 2008, global trade flows collapsed in a historically unprecedented manner (Figure 2, see Eichengreen and O’Rourke 2009 for comparison with the 1930s). As the figure shows, global trade has suffered large blows on three previous occasions in the post-war period but this one is substantially larger.

Figure 2. Historical trade collapses in perspective, 1965 – 2009

Source: OECD Monthly real trade data

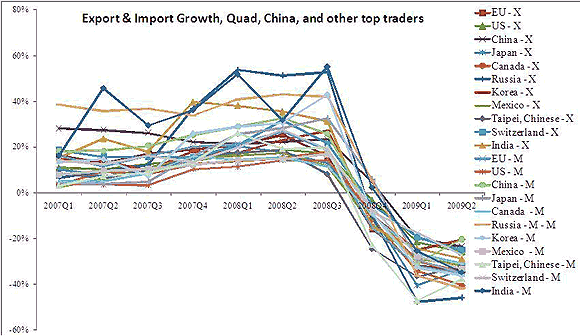

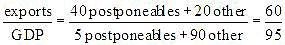

The old “Quad” (EU, US, Japan, and Canada) plus China account for over 60% of world trade. They all saw their exports and imports plummet dramatically, as did the other nations listed in Figure 3. (These 11 nations account for three-quarters of world trade.) Each of these trade flows dropped by more than 20% from 2008Q2 to 2009Q2.

Figure 3. Synchronised drop in all major nation’s exports and exports, 2007Q1-2009Q2

Source: WTO Quarterly merchandise trade data

Causes

With the recession at hand, a trade drop is unsurprising; what shocks is its magnitude. Freund (2009) averaged the world GDP and trade drops for four large recessions (1975, 1982, 1991, and 2001) and found that the trade drop was 4.8 times larger than the GDP drop. This time, global quarter-on-quarter GDP growth was negative in the fourth quarter of 2008 and first quarter of 2009, but over the period of the great trade collapse (2008Q2 to 2009 Q2) IMF data shows world GDP actually rising by 1.5% while global trade dropped about 15%.

Economists around the world have been working hard to understand the causes of this unusually large trade shut down. The findings of over 20 studies will be summarised by the researchers in a VoxEU.org e-book The Great Trade Collapse: Causes, consequences and prospects to be released 27 November 2009 (in time for the WTO Ministerial). The emerging consensus is that this is mostly a demand-side phenomenon with two distinct but mutually reinforcing channels of transmission:

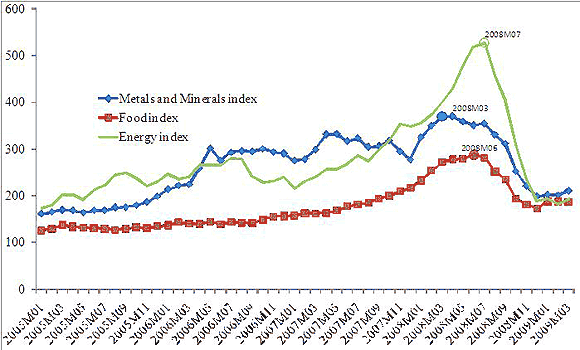

- Commodity prices collapsed with world demand sending the value and volume of commodities trade diving by double digits (food, fuels and raw materials make up a quarter of global trade).

The basic facts are clear from Figure 4; 2007 and 2008 saw a rapid rise in food and fuel prices that collapsed in the summer of 2008 – well before the Lehman’s debacle.

Figure 4. Commodity prices plummet

Source: World Bank (2009a)

- Supply-chain manufacturing collapsed as the Lehman’s-induced shock-and-awe caused consumers and firms to wait and see; private demand for all manner of ‘postpone-able’ consumption crashed.

The manufactures trade drop was amplified many times over by “compositional” and “synchronicity” effects.

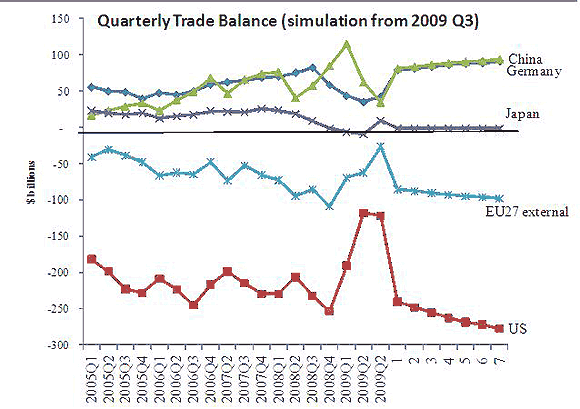

Compositional effect

The nature of the demand shock interacted with the composition of trade and GDP to greatly exaggerate the trade drop. The basic point is best illustrated with a small numerical example. Roughly speaking, world trade consists of about 80% manufactures – most of which are related to the ‘postpone-able’ consumption items such as consumer and investment electronics, transport equipment, and other types of machinery. World GDP, however, consists largely of non-trade-ables, especially services. Say in rough numbers that the value-added involved in postpone-ables is about 10% of world GDP. In the pre-crisis situation, the exports to GDP ratio looks like this:

After the world catches a strong dose of Knightian uncertainty and reacts by freezing until things become clearer, purchases of the postpone-ables slumps – say by half – leading both trade and production to halve. To keep the thought experiment clean, suppose nothing happens to “others” in trade or GDP. The post-crisis situation is:

Due merely to the compositional effect, world exports have fallen 40% while world GDP has fallen only 5%. (Specifically, the percent difference in the numerator’s and denominator’s change is the difference in the share of postpone-ables)

Synchronicity effect

The second simple fact that helps explain why the great trade collapse was so great concerns the fact that almost every nation’s imports and exports fell in this episode. In previous episodes, there was no Lehman-like event to synchronise the wait-and-see stance on a global scale. Another aspect of this is the just-in-time nature of the global supply chain. Even a decade ago, a drop in consumer sales in the US or Europe took months to be transmitted back to the factories and even longer to reach the suppliers of those factories. Today, Factory Asia is online. Hesitation by US and European consumers is transmitted almost instantly to the entire supply chain, which reacts almost instantly by producing and buying less; trade drops in synch, both imports and exports.

For example, during the 2001 trade collapse, monthly data for 52 nations shows that 39% of the month-nation pairs had negative growth for both imports and exports. In the 2008, crisis the figure is 83%. This makes a huge difference. To see this, consider a simple thought experiment. Suppose there are only two possible monthly trade growth numbers +5% and -20%, and there are 10 equal sized nations in the world. If only two-fifths of nations are experiencing the negative growth, the world growth would be -5%; if 80% are experiencing the negative growth rate, the world trade growth rate would be -15%.

As authors of the chapters in the forthcoming VoxEU.org e-book explain, there are indeed many other factors involved, ranging from supply-side causes (like lack of trade credit and banking credit more generally to protectionist measures) to quality shifts.

Looking forward

Taking as read that the great trade collapse was primarily driven by a sudden, synchronised and severe drop in demand, it is clear that trade will recover as demand recovers. Indeed, trade is already bouncing back at a fairly spectacular rate. While the bounce is impressive, it is not unexpected. Indeed all the post-war trade collapses have been followed by very rapid recoveries in trade flows, as Figure 5 shows. The chart plots the three major trade collapses highlighted above. In the 1982 and 2001 episodes, trade returned to its pre-crisis level in two or three quarters after the nadir; the 1975 crisis took four quarters.

Figure 5. Historical trade collapses and recoveries

Source: Authors’ calculations on OECD real monthly trade data

Using the mean of these historical adjustment paths, we can guess the future evolution of world trade in the next few quarters. If 2009Q2 turns out to be the nadir – as the monthly data suggests – world trade should be back to its 2008Q2 level by 2010Q1 or Q2. This matters.

If exports and imports recover quickly – as they have in previous episodes – much of the improvement in global imbalances will vanish just as quickly.

To work out this point more concretely, we use the fitted trade collapse from the three post-war episodes to simulate the path of exports and imports for the world’s main trading nations. Figure 6 shows the results of the simulations for some big traders.

Figure 6. Simulated recovery of exports and imports

Source: Authors’ calculations based on WTO quarterly trade data and Figure 5

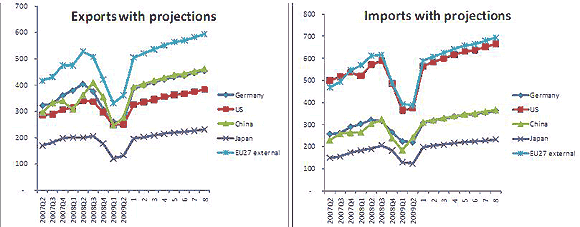

Simulated trade imbalances implied by these figures are shown in Figure 7. This shows the simulated evolution of trade imbalances if the general trade recovery occurs without major structural and real exchange rate adjustments in the main deficit and surplus nations.

The findings are in line with the simple intuition that the rapid improvement in global imbalances without major structural changes is likely to be transitory.

The point can be made a little more crisply with some accounting identities. The trade balance is exports minus imports. Pure logic tells us that if both exports and imports fall by, say, 15%, then all nations’ trade balances will improve, i.e. move towards zero, by 15%. Or more pedantically: X (1-g) – M (1-g) NX (1-g).

Figure 7. Simulated global imbalances implied by recovery from the great trade collapse

Source: Authors’ calculations based on WTO quarterly trade data and Figure 5

Concluding remarks

Do global imbalances matter? Is their continued existence driving the world economy towards another global crisis? These are questions on which macroeconomists have not yet formed a consensus. The IMF and World Bank have calmed the waters by projecting reductions in the imbalances of the world’s largest trading nations – especially China and the US.

This column points out that these projections of improving imbalances are almost surely wrong. The rapid collapse of trade between the third quarter of 2008 and the first quarter of 2009 improved most balances of trade. It could not have done otherwise; if both imports and exports drop rapidly, the gap between them drops equally rapidly. In the same mechanistic manner, the recovery of trade flows – a recovery that seems to have started this summer – will almost surely return the US, Germany, China and others to their old paths.

NOTE: These views represent those of the authors and not necessarily the institutions for which they work.

Reference

•Calvo, Guillermo (2009), “Reserve accumulation and easy money helped to cause the subprime crisis: A conjecture in search of a theory,” VoxEU.org, 27 October.

•Eichengreen, Barry and Kevin O’Rourke (2009), “A Tale of Two Depressions,” VoxEU.org, 6 April.

•Freund, Caroline (2009), “Demystifying the trade collapse”, VoxEU.org, 3 July.

•IMF (2009), World Economic Outlook, Table A10. Summary of Balances on Current Account, October.

•Paulson, Henry (2008), “Remarks by Secretary Henry M. Paulson, Jr. on Financial Rescue Package and Economic Update,” Speech HP-1265, 12 November.

•World Bank (2009a), “Global Economic Prospects 2009”.

•World Bank (2009b), “Transforming the Rebound into Recovery” East Asia and Pacific Update November.

![]()

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply