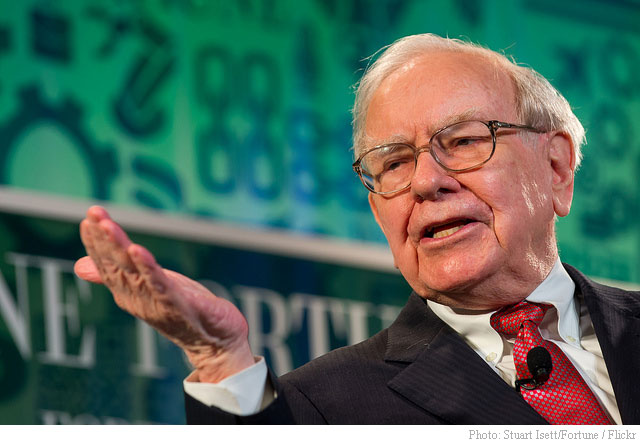

Warren Buffett, the legendary investor known for his long-term value investing strategy, has once again signaled a cautious approach to the stock market through his conglomerate, Berkshire Hathaway (BRK-A), (BRK-B). In the third quarter, Berkshire continued to divest from significant holdings, notably reducing its stake in Apple (AAPL) by approximately 100 million shares. This move follows a similar strategy seen in previous quarters where billions of dollars of Bank of America (BAC) shares were also sold off.

This strategic retreat from stocks comes alongside an increase in Berkshire’s cash reserves, which have now reached a record high of $325.2 billion. This stockpile of cash underscores Buffett’s preference for liquidity in times when he perceives the market valuations to be less than attractive for investment. Interestingly, despite the company’s intrinsic value, Buffett did not repurchase any of Berkshire Hathaway’s own stock during this period, indicating a belief that even his own company’s shares are not undervalued enough to warrant buying back.

On the operational front, Berkshire experienced a downturn with its operating profit declining by 6% to $10.09 billion, translating to about $7,019 per Class A share. This decrease reflects challenges within its diverse business segments including BNSF railroad and Geico car insurance, which have been impacted by various market conditions and operational issues.

Despite the reduction in operating profit, Berkshire’s net income showed a dramatic turnaround, posting $26.25 billion, or $18,272 per Class A share, a stark contrast to the $12.77 billion loss from the previous year, largely due to the recovery in stock prices which positively affected the valuation of Berkshire’s investments.

This financial maneuvering by Buffett and his team at Berkshire Hathaway reflects a broader strategy of capital preservation over aggressive expansion, choosing to hold cash in anticipation of more favorable investment opportunities or possibly preparing for market downturns. This approach not only exemplifies Buffett’s investment philosophy but also highlights his cautious outlook on the current economic landscape, where he seems to find more comfort in liquidity than in equity investments.

h/t Reuters

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply