William Sterling of Trilogy Global Advisors has an interesting new paper on the abrupt changes in financial markets subsequent to Lehman’s bankruptcy on September 15, 2008.

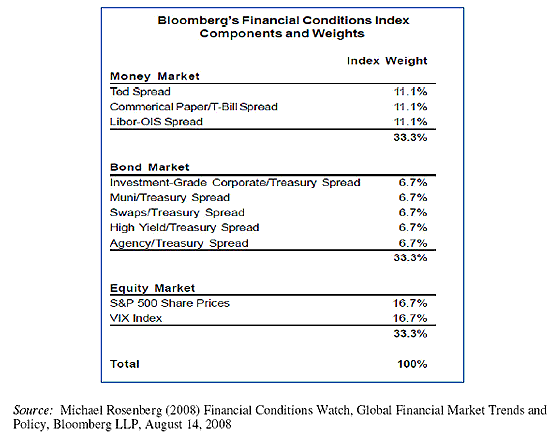

Sterling’s paper is in part a response to earlier analyses by John Taylor (2008, 2009) and John Cochrane and Luigi Zingales who noted that the spread between the LIBOR interest rate (London Interbank Offered Rate) and the OIS (Overnight Index Swap) rose only gradually following the Lehman (LEHMQ) bankruptcy, leading these scholars to see Lehman as just one of many relevant developments at the time. But Sterling questions the meaningfulness of the LIBOR or OIS indicators during these weeks given that markets seized up and little trading activity was occurring in these instruments. Sterling instead proposes to take a look at Bloomberg Financial Conditions Index, which Bloomberg launched in August 2008. The index is based in part on the observations by Rick Mishkin on some of the regularities observed in earlier historical financial crises. The components of the Bloomberg index are as follows:

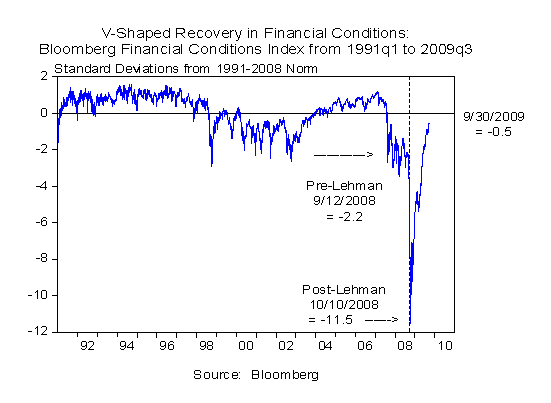

Here’s Sterling’s graph of the behavior of the Bloomberg index, in which the remarkable character of events following September 12 is pretty striking.

Even if the Lehman failure is agreed to as a definitive event, it is not clear to me that this establishes that all would have been fine if the Fed had only bailed out Lehman as they had Bear Stearns and AIG before. That question is inherently and unavoidably counterfactual. We can’t know– and decision-makers at the time couldn’t know– which domino might have been next to fall had this one been propped up.

But I think it is fair to conclude that the middle of September of 2008 marked a clear turning point in the unfortunate sequence of events through which we have recently come.

Graphs: Sterling (2009)

Consequences of the Lehman failure

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply