It is no secret that the Bush Administration was in favor of tax cuts through thick and thin. In fact, Bush made tax cuts the centerpiece of his domestic agenda. Whether the federal budget was running surpluses or historic deficits ; whether in the midst of a booming economy or a recession, Bush’s top economic policy initiative was to cut taxes. One such initiative was that of providing benefits almost exclusively to the very wealthiest Americans, including cuts in the tax rates on income from capital gains and dividends, reductions of the estate tax, and reductions in the top individual income tax rates. Based on that initiative, millionaires, who represent only 1% of American households, will get an average tax cut of $135K, or 21.5% of the benefits from the tax cuts in 2009. In contrast, households with incomes below $40K, representing 50% of households, will get just 8%.

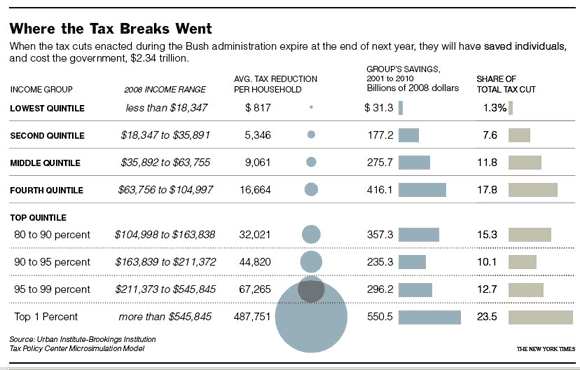

Since nearly all of the tax cuts enacted during the Bush era are set to expire at the end of 2010, the NYT has put together an interesting chart (below) which shows the cuts may cost the gov’t $2.34 trillion.

Where the tax break went

Graph: NYT

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Actually about 7% of households in the U.S. have a net worth (including first home) in excess of one million dollars…

The number of households with a yearly income of one million is less than 1%

Appears that households that pay about 95% of the taxes got about 60% of the tax cut.