If you’ve ever been punched in the solar plexus or had the wind knocked out of you, then you probably know how risk assets feel right now. When Macro Man threw the steaks on the barbie last night, the SPX was pushing 1100 and oil was nearly $82/bbl. When he checked his screen 40 minutes later, he could almost literally hear the “ooooooooooooof!” being cried by Spoos.

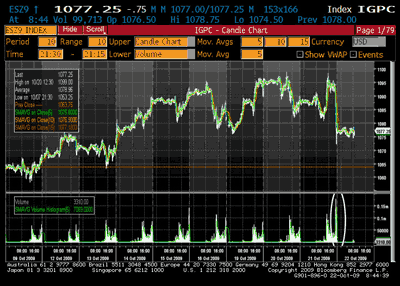

Ex post, a number of reasons were given for the sell-off: Bove downgrading WFC, Obama announcing pay caps on TARP banks, a disappointing Wal-Mart call, etc. The real answer, however, is a bit more prosaic: a couple of huge ($5 billion) sell tickets went through in the last 40 minutes or so of trading, which naturally pushed the price lower. You can see the impact on the intraday volume chart below.

(click to enlarge)

Meanwhile, other sacred (risky) cows are being ushered to Dr. Market’s abattoir. Over the past few weeks Macro Man has pointed out the apparent distribution trend in Korean equities. Despite this, the won had remained relatively resilient, in conjunction with the splendid performance of broader stock markets. Starting last Friday, however, there has been something of a fire-in-the-theater rush for the exits in KRW, INR, and other Asian currencies. Even USD/RMB forwards have seen some short-overing.

(click to enlarge)

As long as the Fed remains accommodative (and yesterday’s Beige Book suggests that it will), this sell-off in stuff like EMFX is probably little more than a bit o’ flamingo hunting. (There has been some rumbling that recent FX price action is related to the Galleon closure, but the relatively small AUM of their non-equity books suggests that this is wide of the mark.)

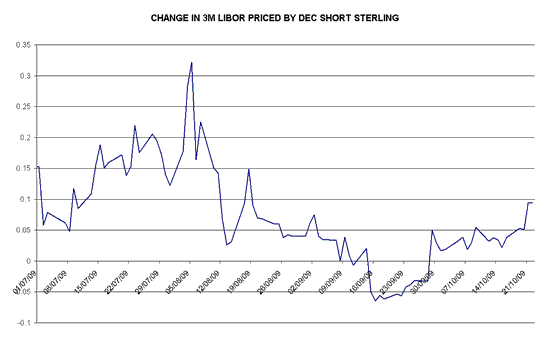

One market clearly seeing pink flamingos being shot down is short sterling. Yesterday’s BOE minutes suggested little appetite to expand QE, and even suggested that some members are getting a trifle concerned about the Bank’s relatively sanguine longer term inflation forecast.

Cue the predictable ralling in sterling (the currency) and kiboshing of sterling (the interest rate contract.) While Macro Man does have sympathy with the notion that Merve will wake up one day and Swerve hawkishly (and thus understands the recent carnage in the reds), the recent kiboshing of front Dec looks decidedly flamingo-y, and may have overshot.

As the chart below demonstrates, front Dec is now pricing 3m LIBOR near y10 bps higher than the current reading. The would put the spread over the BOE’s interest on reserves at 16-17 bps. Compare that with, say, the US, where 3m LIBOR is currently just 3 bps over the 25 that the Fed pays on its reserves.

Ultimately, Macro Man suspects that liquidity will remain ample this side of new year, and that front Dec sterling looks like it’s starting to offer some value.

Perhaps there is actually a little too much liquidity, at least in the US. news that John Meriwether is going for strike three literally beggars belief. Sadly, it’s been Macro Man’s experience that European investors don’t have nearly as much money to piss away……..

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply