The bears come out at any downturn, and they are out tonight. Why the joy? Surely not just the last hour drop. Yet it was a classic Bifurcation moment, at least of the recent trend: it fell faster than the uptrend, and broke below the trading range of the past 10 days, since a gap up. The general feeling is captured by Evil Speculator: “We Topped.”

The STU may have pushed social mood towards giddy bearishness. The downward reversal pretty well signals continued weakness. A break of their 0-X lower trendline (now around Sp1046 or Dow9455) would confirm. They found a “quadruple outside-down” day in the Wilshire 5000/Trannies/S&P500/S&P100. All the main levels have been hit:

- the Sp1099 gap was filled

- the Dow10122 “4th of the prior 3rd” was hit close enough (within 3 pts)

- the Naz2183 gap was filled

On top of this, Tony Caldero has continued his precise ewaving with a post tonight on the Sp1080.77 low breaking below a recent wave iv 1082 level, and very very close to the Sp1080.15 level of what once seemed the top on Sep23. The break of the just prior wave iv indicates this is no longer a small jink and jove of a subdividing wave up, but a larger degree correction. Whether it is the end is not yet confirmed but at least it points to serious weakness over the next few trading days.

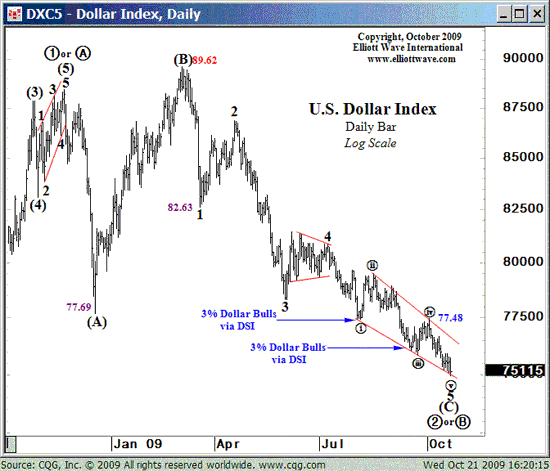

About the only non-confirmation was over in the Dollar Index. The DX hit the lower trendline today at just below DX75, but the STU has been watching for a throw-under and sharp reversal at DX74.50. The great thing about the pattern the DX is in, the ending diagonal, is it is clearly a terminal pattern and will be followed by a reversal up. The only question is when. The throw-under and reversal would be a classic indicator of when, but is hasn’t happened, and need not to end the pattern. The closing wedge shape is clear, albeit could run for a while before still.

Gold has formed a triangle, the penultimate pattern, indicating another (and final) thrust up is about to occur in gold. Probably the spike down in the Dollar and run-up in gold occur around the same time. So watch gold first to give advance warning of the Dollar Bottom.

I will post shortly on bonds, but suffice to say right now that the wave pattern is ambiguous. Best to wait for clarity before taking a position.

By far the most interesting discussion in the STU was around the banking index, which shows a fairly clear top. This would be huge as the bank stocks have been like the Nifty Fifty, or in this case the High Five: a small number of stocks = a major part of the rise. This sort of situation is bearish: a bull market runs up on a broadening base while a bear rally runs out of steam on a narrowing base. Their sudden weakness presages more than a drop in the Dow; it signals a return of the credit crisis.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply