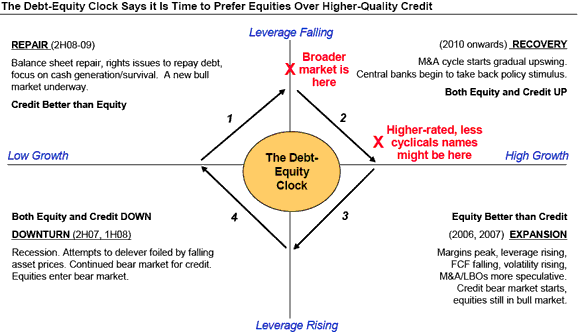

The debt-equity clock, a methodology developed by Morgan Stanley (NYSE:MS), describing the performance of corporate debt and equity securities across the different stages of a credit, or business cycle ; appears to be indicating that it’s time to prefer stocks over bonds. According to Morgan, we are entering the recovery phase — a phase when co.’s benefit from the restructuring carried out earlier — after having been in the repair phase of the cycle where companies focus primarily on balance sheet repair and survival.

We don’t know how reliable of an indicator the clock is, or if anyone actually follows it as a part of their decision making process. But what we do know is that stocks have already outperformed bonds by a significant margin, raising the question if Morgan is being perhaps a bit late in the game.

The debt-to-equity clock

Graph: The Pragmatic Capitalist

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply