Microsoft Corp. (NASDAQ:MSFT) stock is up $0.21 to $64.48 in after-hours trading Thursday after the company reported its FY17 second-quarter earnings results.

The software giant posted non-GAAP earnings of $0.83 per share on revenues of $26.07 billion, up 1.5% from a year ago. Analysts were expecting EPS of $0.79 on revenues of $25.29 billion. Microsoft said revenue in Intelligent Cloud was $6.86 billion and increased 8% (up 10% in constant currency), ahead of the guidance the company had set of between $6.55 billion to $6.75 billion. Analysts expected the company’s cloud segment to bring in about $6.73 billion. Revenue from Azure, Microsoft’s major cloud offering, jumped 93 percent year over year with its commercial cloud annualized run rate passing $14 billion. In October, Azure saw revenue growth of 116 percent.

Meanwhile “productivity and business processes” revenue was up 10% and $7.4 billion.

CEO Satya Nadella highlighted out advances in artificial intelligence, stating: “Accelerating advancements in AI across our platforms and services will provide further opportunity to drive growth in the Microsoft Cloud.”

The company’s “More Personal Computing” division saw revenue decline 5% to $11.8 billion driven primarily by lower phone revenue.

This was the first quarter since Microsoft closed its $24 billion acquisition of LinkedIn which accounted for $228 million in revenue and a net loss of $100 million for the quarter.

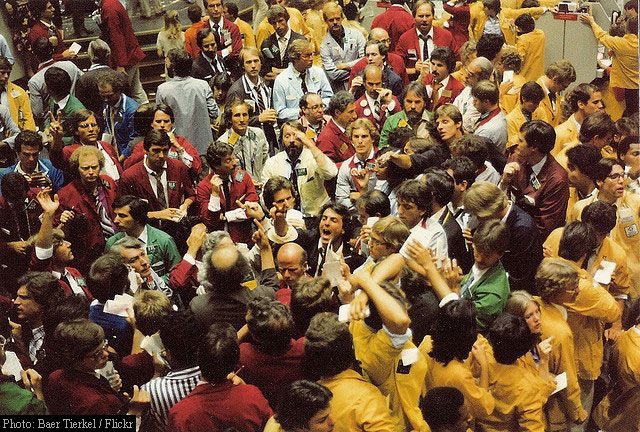

Earlier Thursday, as the Dow hit 20,100 points, Microsoft stock printed a new all-time high of $64.54. The median Street price target on the name is $69 with a high target of $80. Currently ticker boasts 23 ‘Buy’ endorsements, compared to 9 ‘Holds’ and 2 ‘Sell’.

MSFT is up nearly 23 percent year-over-year, and 3.43% year-to-date.

—

Google-parent Alphabet Inc (NASDAQ:GOOGL) dropped $18.65 to $813.50 in after-hours trading after it reported fiscal results for the fourth-quarter.

In its quarterly report, the search giant said it earned $9.36 per share, slightly below the $9.62 per share analysts were expecting. Revenue rose 22.2% y/y to $26.06 billion, above views for $25.14 billion. The increase is attributed to advertisers who are spending more to reach an expanding user base that spends more time on smartphones and YouTube.

“Our growth in the fourth quarter was exceptional — with revenues up 22% year on year and 24% on a constant currency basis., said in a statement Ruth Porat, CFO of Alphabet, adding “This performance was led by mobile search and YouTube. We’re seeing great momentum in Google’s newer investment areas and ongoing strong progress in Other Bets.”

Alphabet’s “Other Bets” revenue increased to $262 million from $150 million a year earlier.

Mountain View also said the “paid clicks” in its Google advertising business rose by 36% compared with a 33% increase in the third quarter, while cost per click declined by 15%.

GOOGL currently prints a one year return of about 15%, and a year-to-date return of 8.14%.

Leave a Reply