Macro Man has thus far avoided the great “deflation versus inflation” debate, at least publicly, for a couple of reasons. The first is that he doesn’t think the outcome will be as black and white as many of the debate’s participants; he suspects the underlying dynamic is heavily dependent on the velocity of money, and so he prefers to focus his analytical energies in that direction. Moreover, the tone of the debate has taken on a quasi-religious tone, which is rarely conducive to the sort of open-minded give-and-take that yields substantive results.

However, it’s probably worth touching on some small aspect of the debate, as behind the scenes it seems as if the same is happening at the Fed. Don Kohn’s recent speech highlighted the large size of the output gap, a view largely echoed in last night’s FOMC minutes. Yet at a recent St. Louis Fed conference, Bank president James Bullard offered a somewhat contrary view-namely that the collapse of the bubble has eradicated some of the productive capacity of the economy, thus rendering the output gap smaller than commonly believed.

This is an interesting and important issue, not least because the Greenspan Fed’s belief in a large output gap was a major factor behind the policy mistake of leaving rates too low for too long in 2003-04.

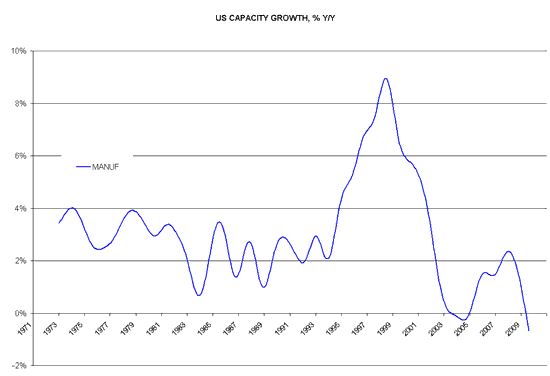

Macro Man must confess that he has some sympathy for Bullard’s view. A quick look at US manufacturing capacity, for example, shows that it has actually shrunk over the past year. Not as much as demand for that capacity has, of course, but still….it’s quite a telling sign. While there is no accurate official measure of the total capital stock, Macro Man has to believe that it has been depleted as well.

Of course, a counter-argument to the notion of a smaller “national” output gap is the fact that consumer-driven Anglo-Saxon economies have essentially outsourced their manufacturing capacity, so you need to consider the notion of a “global” output gap. Well, perhaps….but even then there is no assurance that there is a limitless supply of foreign-made manufactured goods. The UK and US in particular- deficit countries with weak currencies- have seen foreign makers of certain goods drastically reduce the supply of their wares.

One small anecdote- Macro Man is looking to replace Mrs. Macro’s Volvo station wagon. He’s got his eye on a few different Audi models (Q5, A4 estate.) There is basically no inventory in the UK, and no intention on the part of dealers to replenish inventory, so all cars have to be made to order . If you’re lucky, you’ll get a new one in March or April….at the earliest. Meanwhile, the prices of used cars have unsurprisingly ticked higher as well. So much for the yawning output gap…

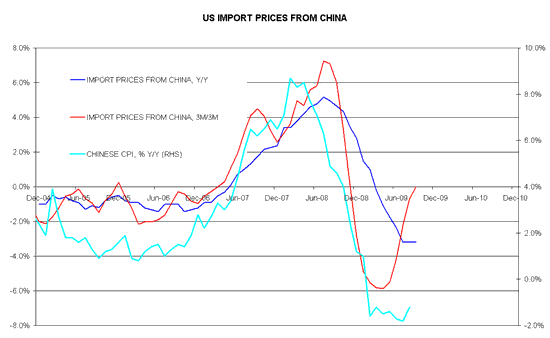

Yesterday’s post examined certain relationships in international trade. Macro Man suspects that most observers would concede that China has become the United States’ foreign manufacturer of choice. Given the combination of a) continued overcapacity in China, b) the ongoing relative paucity of demand in the US, and c) the steadiness of the USD/RMB exchange rate, it seems reasonable to accept that US import prices from China should be low and falling, right?

While it’s certainly the case that import prices from China are still down year-on-year, intriguingly, the quarterly change in import prices has returned to zero. In other words, there is no marginal deflationary trend in US import prices from China. If (or rather, when) domestic inflation in China starts to rise, courtesy of PBOC’s helicopter money-drop, it seems reasonable to posit that US import prices from China will begin to rise.

Whither that global output gap?

So it was with great interest last night that Macro Man read of the divergence of views on the FOMC. One member wanted to reduce QE by not buying the full slate of MBS. AT least two voters, on the other hand, wanted to increase QE- despite the bounce in the data and the uber-rally in risk assets.

Now that the world is no longer coming to an end at the speed of light, it seems as if the Bernanke Fed is reverting to its original communications philosophy (i.e., members will be allowed to speak their own minds rather than toe the party line.) Given the disparity of views on the committee and amongst non-voting regional presidents, this seems likely to enegender a fair amount of volatility.

That the balance of opinion last month leaned towards more, rather than less, QE, could well introduce more of a risk premium into US markets. The curve has steepend quite a bit in recent days as flatteners have been taken off.

(click to enlarge)

At the same time, the dollar is once again on the back foot (even falling against sterling this morning!), as it should be given the quiescent attitude towards expanding QE. Ultimately, of course, the free lunch of dollar weakness may prove to have a bill, after all. That the oil price is threatening to break out of its recent range is perhaps an ominous signal; if inventories show a decent draw this afternoon, it could be off to the races.

And once again, the market will be left to wonder how big the suposedly yawning (energy) output gap really is, at least in the short run…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply