While The Donald met with President Obama yesterday, the Dow gained more than 200 points.

That’s another triple-digit gain on the back of Trump’s improbable victory. The Dow Jones Industrial Average is now sitting at new all-time highs.– and the Trump Train that’s powering the markets higher looks unstoppable…

Or does it?

As the country digests the idea of Donald J. Trump taking the helm as the next commander-in-chief, Californians are threatening to “take our avocados and legal weed and go”. Protests are popping up across the state, while the hashtag #Calexit trends on Twitter.

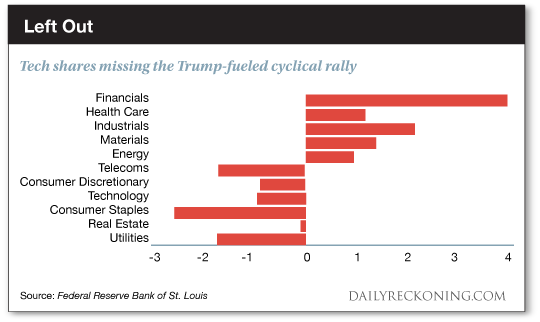

As California and the ultra-liberal Silicon Valley denizens are losing their collective minds, their beloved tech stocks are taking a beating. The Dow and S&P 500 finished Thursday in positive territory. The Nasdaq dropped nearly 1%.

The famous FANG foursome – Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), Google (NASDAQ:GOOGL)—has found itself at the forefront of most major market moves over the past 24 months. But not this week…

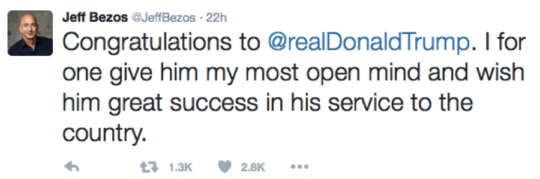

By the end of the day, most major tech stocks were afloat in a sea of red. Apple dropped 2.8%. Google shed more than 3%. Amazon lost almost 4% on the day. Even Jeff Bezos—who has been a vocal Trump critic—tried the salvage the day with a tweet:

Maybe throw in a year of Amazon Prime for free?

So what gives?

Bloomberg claims the FANG brethren have taken a tumble due to worries over Trump’s policies on overseas trading— or even because investors are afraid of retaliation aimed at tech companies for not supporting him during the campaign. After all, Silicon Valley did go all-in for Clinton…

We’re not so sure.

After all, what are Trump’s global trade policies, exactly? I don’t think anyone can answer this question just yet.

The real story here is simply that investors are nervous. They’re frantically trying to figure out how to position their portfolios for a Trump presidency. But no one’s really sure what that even means.

That leads to the wild swings we’ve seen this week…

One of the most curious rotations is the rally in private prison stocks. The major names in this industry jumped double-digits yesterday—presumably on Trump’s tough-on-crime talk.

“That’s a stunning development in light of all the marijuana ballot measures that passed on Tuesday; going forward, many fewer people stand to be locked up for simple possession,” notes our own Dave Gonigam over at The 5 Min. Forecast. “But the Street seems to be betting that Trump’s general law-and-order stance — and his specific pledge to crack down on illegal immigration — will keep America No. 1 among all nations when it comes to the percentage of its population behind bars. USA! USA!”

We’re expecting additional quick moves in the coming weeks as more details about Trump’s actual plans and policies emerge. What we’re witnessing is some of the fastest sector rotation the market’s seen in a long-time. Despite the velocity of some of these moves, it will still take time for everything to shake out.

Leave a Reply