Priceline Group Inc (NASDAQ:PCLN) stock has been on a tear this morning, rising as much 68 points to a high of $1,426 and change following the company’s better-than-expected Q216 earnings, reported after Thursday’s closing bell.

In its quarterly report, the Norwalk, CT-based online travel company said it earned $13.93 per share, well above the $12.69 per share analysts were expecting. Revenue jumped 12% on a year-over-year [y/y] basis to $2.56 billion, headlined by a 24% y/y room-night growth and $60 million in EBITA upside. Still, profits came in a tad shy of Wall Street estimates for $2.58 billion.

Priceline also said it logged a 19% year-over-year jump in gross travel bookings, which came at at nearly $18 billion for the second quarter, as more people used its sites to book summer vacations.

“Globally, our accommodation business booked 141 million room nights in the second quarter, up 24% over the same period last year,” Interim CEO Jeffery Boyd said in a company statement, adding “[w]e believe this consistent growth demonstrates the strength of our brands, the value of a diversified global footprint and solid execution by our brand management teams.”

Priceline also said it plans to increase spending on Facebook (NASDAQ:FB) ads.

Following the company’s 2Q results, analysts at Benchmark raised their PCLN stock price target by 11% to $1,600 per share from $1,440 per share, noting 3Q16 guidance was also healthy, with the street falling well within the high-end of the range on all metrics.

For the 2016 third quarter, Priceline guided revenues of $3.47 to $3.63 billion, as compared to analysts’ expectations of $3.57 billion. The management also gave its bottom line range of $28.30 to $29.80 per share, against projections of $28.96 per share.

Alongside Benchmark, Piper Jaffray also issued a research report on Priceline stock, raising their price target by 125 points to $1,625 per share. Additionally, Oppenheimer’s Jed Kelly raised his PCLN price target to $1,640 from $1,420, noting the company’s high-end third-quarter room-nights/bookings guidance represents “solid” growth despite some macro softness and competitive pressures, reflecting Priceline’s best-of-breed capabilities.

Stock Action

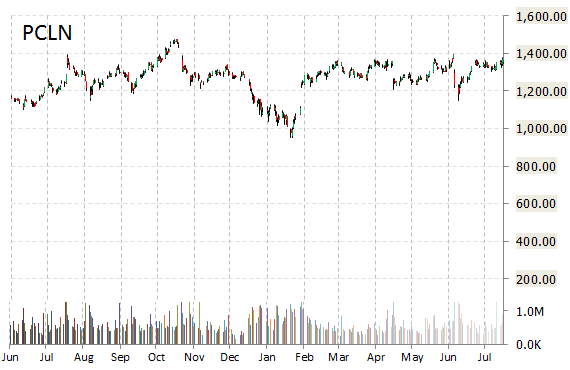

PCLN shares have advanced 5.26% in the last 4 weeks and 9.60% in the past three months. Over the past 5 trading sessions the stock has gained 2.56%. The $70 billion market cap company, which currently has a median Street price target of $1,475 with a high target of $1,770, is up nearly 7% since Jan. 1, slightly outperforming the 6% rise in the S&P 500 Index.

Take Some PCLN Money Off the Table

Priceline’s march back to yearly highs began in mid February and has been a relatively steady climb since that time. Ticker had a 200+ point nosedive in late June but was able to recuperate losses within two weeks and close above the $1,350 level. That said, and while the stock has been holding above its 50-day moving average located at $1,317.51 level since July 8, it’s always prudent to book some profits here as ticker looks a bit over-extended. Technically speaking, the issue needs to pull back and consolidate nicely before getting ready for the next leg up. I’d say wait for the 50-day MA to catch up to where ticker currently trades. It’s at that point the Priceline stock becomes a long candidate again.

Leave a Reply