Microsoft Corporation‘s (NASDAQ:MSFT) workforce restructuring continues, as the company disclosed in a 10-K filing on Thursday that over the next 12 months it plans to cut an additional 2,850 jobs on top of 1,850 announced in May 2016. The Redmond, Washington-based company said that about 900 of those selected workers have already been notified of its plans. The cuts, which are mostly related to Microsoft’s disastrous $7.9 billion Nokia acquisition, are expected to be completed by the end of fiscal year 2017.

“We periodically evaluate how to best deploy the company’s resources”, Microsoft said in its filing, adding that in 4Q16 “management approved restructuring plans that would result in job eliminations, primarily across our smartphone hardware business and global sales. In addition to the elimination of 1,850 positions that were announced in May 2016, approximately 2,850 roles globally will be reduced during the year as an extension of the earlier plan…”

In connection with the restructuring plans, Microsoft said it incurred restructuring charges of $501 million in 2016, including severance expenses and other reorganization costs. The company added it does not expect to incur additional charges for these restructuring plans in subsequent years.

As of June 30, Microsoft had about 114K full-time workers, with 63K of those in the United States, the SEC filing said.

The latest round of job cuts comes as the software giant takes on thousands more workers with its planned $26.2 billion acquisition of online professional network operator LinkedIn Corp (LNKD).

UBS analyst Brent Thill, who has a ‘Buy rating and a $62 price target on Microsoft stock, writes in a research note to investors that productivity in categories such as Service, which includes Office 365, Azure, Microsoft’s public cloud computing platform, and Dynamics CRM, Msoft’s customer relationship management software, grew to 10 percent of total revenue for the first time in fiscal 2016. It is to be noted that the Service revenue is up in advance of bringing on the LinkedIn employees, who according to Thill are “expected to add another 10K to total headcount, with the deal expected to close in CY16.”

Stock Reaction

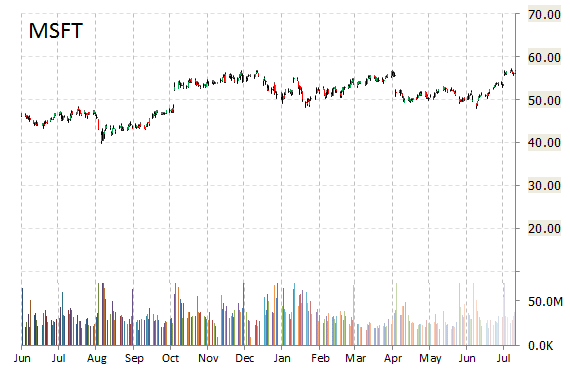

Shares of Microsoft closed at $56.68 on Friday. The name has advanced 13.69% in the last 4 weeks and 13.43% in the past three months. Over the past 5 trading sessions the stock has gained 0.73%. The $442.6 billion market cap company has a median Street price target of $60.00 with a high target of $70. As for passive income investors, the company pays shareholders $1.44 per share annually in dividends, yielding 2.56%.

Currently MSFT boasts 18 ‘Buy’ endorsements, compared to 12 ‘Holds’ and two ‘Sell’ ratings.

Microsoft’s stock is up about 25% year-over-year, compared with a gain in the 2.9% in the S&P 500.

Leave a Reply