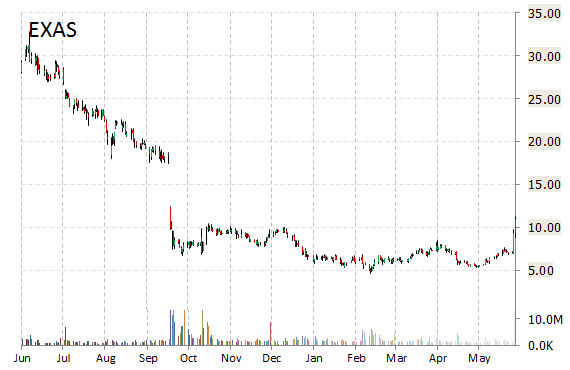

Analysts at Craig Hallum are out with a report today upgrading shares of Exact Sciences Corporation (EXAS) with a ‘Buy’ from ‘Hold’ rating. The firm set its price target for the Madison, Wisconsin-based molecular diagnostics company at $18. In the past 52 weeks, shares of Exact Sciences have traded between a low of $4.67 and a high of $32.85 and are now at $11.11.

Shares are down 64.92% year-over-year ; up 1.08% year-to-date.

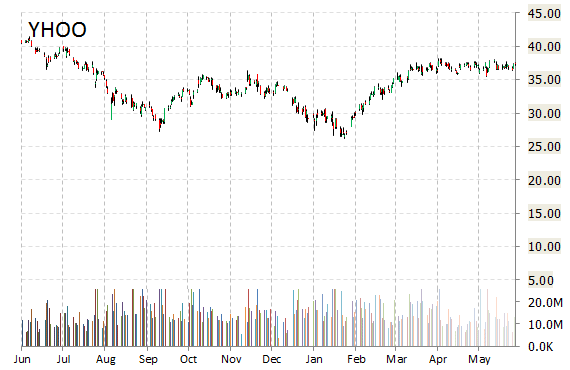

Analysts at Citigroup (C) upgraded their rating on the shares of Yahoo! Inc. (YHOO). In a research note published on Thursday, the firm lifted the name with a ‘Buy’ from ‘Neutral’ rating and a 12-month base case estimate of $43 from $37, which represents a 16% upside to ticker’s current trading price. Citi cited several factors that attributed to YHOO’s upgrade, including the auction for assets, Alibaba‘s (BABA) recent positive outlook and the stock’s performance since Citi’s downgrade in March. Citi also said Yahoo’s core business will likely be sold for at least $5 billion.

Yahoo shares fell roughly 0.8% along with the broader market.

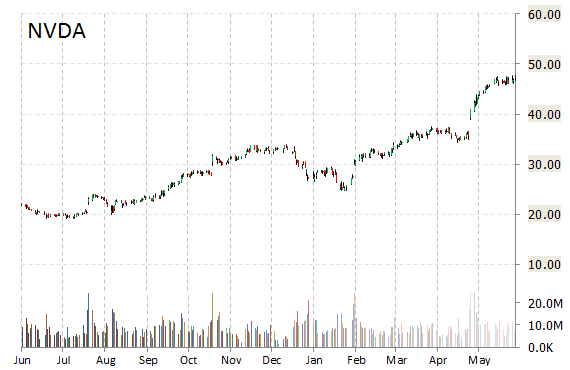

Nvidia Corporation (NVDA) was reiterated a ‘Buy’ by Canaccord Genuity analysts. The broker raised its price target on the stock to $55 from $45.

Nvidia shares have advanced 12.55% in the last 4 weeks and 43.45% in the past three months. Over the past 5 trading sessions the stock has gained 2.56%. The $25.12 billion market cap visual computing company has a median Street price target of $45.00 with a high target of $56.

NVDA is up 125.21% year-over-year, compared with a 2.34% loss in the S&P 500.

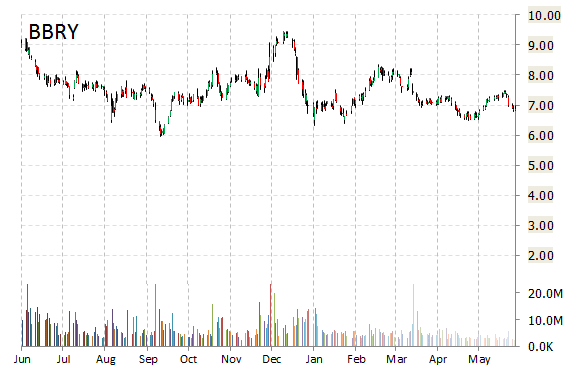

BlackBerry Limited (BBRY) was reiterated as ‘In-line’ with a $7 from $7.50 price target by Imperial Capital. The firm thinks investors will likely remain on the sidelines until the smartphone maker delivers stronger growth momentum and improved visibility.

BBRY shares are currently trading at $6.85.

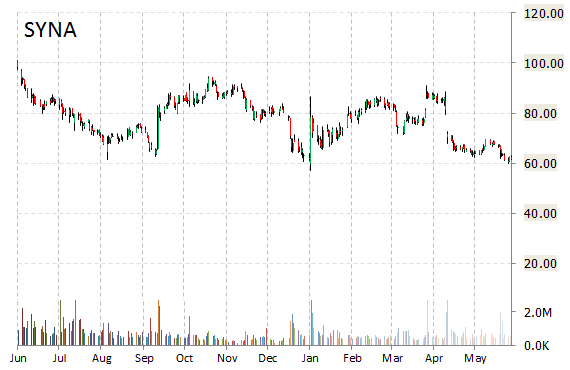

Synaptics Inc. (SYNA) rating of ‘Neutral’ was reiterated today at Mizuho with a price target decrease of $68 from $75 (versus a $61.81 previous close). SYNA is down $1.47 at $60.34 in midday trade, moving within a 52-week range of $57.02 to $102.50. The name, valued at $2.22 billion, opened at $61.10.

Leave a Reply