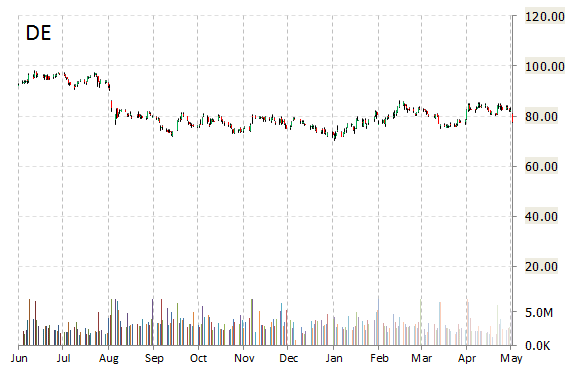

Deere & Company (DE) was reiterated a ‘Neutral’ by Piper Jaffray analysts on Monday following Q2 result. The broker raised its price target on the stock to $76 from $75.

On Friday Deer & Co. reported earnings of $1.56 per share on revenues of $7.11 billion, down 3.9% from a year ago. Analysts were expecting EPS of $1.48 on revenues of $6.66 billion. Net income came in at $495.4 million, or $1.56 per share, compared with $690.5 million, or $2.03 per share, YoY basis.

In terms of the third-quarter, the manufacturer of construction and forestry equipment guided revenues of 6.02 billion, as compared to analysts’ expectations of $6.17 billion.

Deere stock recently traded at $78.27, a gain of $0.53 over Friday’s closing price. The name has a current market capitalization of $24.68 billion.

As for passive income investors, the Moline, Illinois-based company pays shareholders $2.40 per share annually in dividends, yielding 3.09%. Five year average dividend yield currently stands at 2.38%.

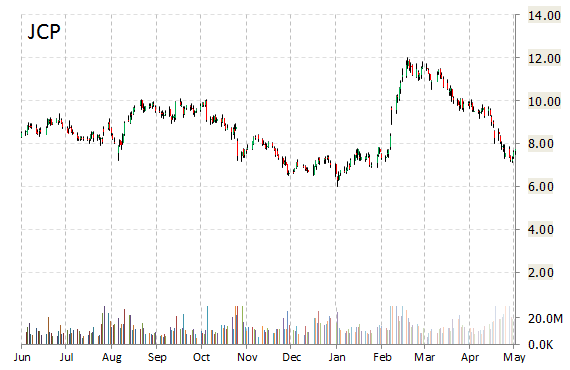

J. C. Penney Company, Inc. (JCP) was reiterated as ‘Buy’ with a $13 from $17 price target on Monday by Miller Tabak. The firm believes that the overall environment for department stores makes it unlikely for JCP to reach its targets of $1 billion and $1.2 billion in FY 2016 and 2017, respectively.

JCP shares have traded today between $7.70 and $7.96 with the price of the stock fluctuating between $6.00 to $11.99 over the last 52 weeks.

J.C. Penney Co. shares have a t-12 price/sales ratio of 0.19. EPS for the same period registers at ($1.41).

JCP gained $0.01 to $7.75 in midday trading on Monday, giving it a market cap of roughly $2.4 billion. The stock traded as high as $11.99 on March 8, 2016.

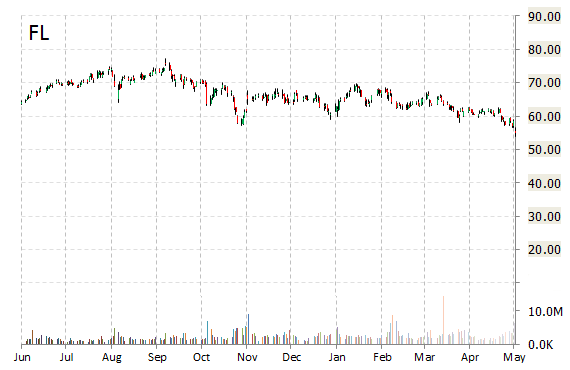

Foot Locker, Inc. (FL) rating of ‘Buy’ was reiterated today at Canaccord Genuity with a price target decrease of $75 from $81 (versus a $54.77 previous close). Foot Locker was also lowered to $72 from $78 at Telsey Advisory Group.

In the past 52 weeks, shares of New York-based athletic shoes and apparel retailer have traded between a low of $53.83 and a high of $77.25. Shares are down 13.07% year-over-year and 15.13% year-to-date.

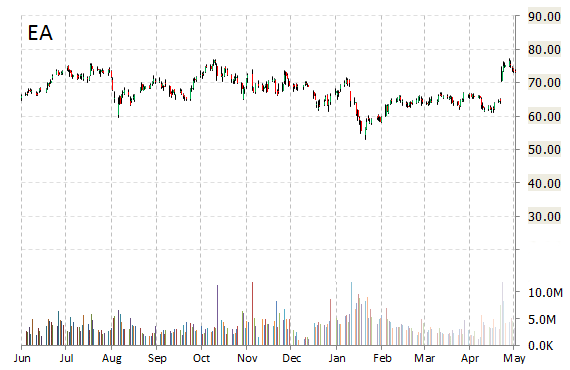

Electronic Arts Inc. (EA) was reiterated as ‘Buy’ with a price target increase of $93.80 from $82.64 at The Benchmark Company. The price target hike was given after the firm’s meetings with the management. TBC said they feel Electronic Arts’ long term financial objectives are achievable.

EA was up $0.19 at $73.30 in midday trade, moving within a 52-week range of $53.01 to $77.15. The name, valued at $22.67 billion, opened at $73.39.

Leave a Reply