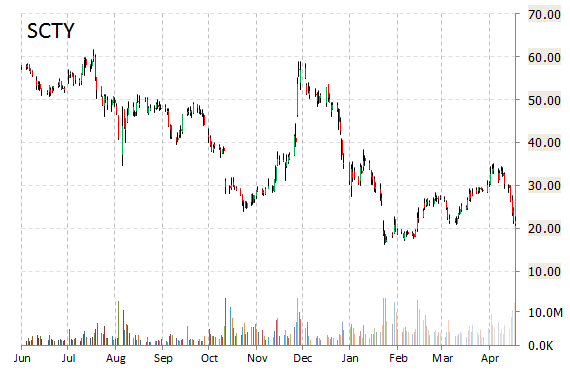

Shares of SolarCity Corporation (SCTY) are down $3.16 to $19.35 after the company released its earnings results on Monday. The firm reported Q1’16 EPS of ($2.56) per share vs. ($2.37) consensus on $122.57 million in revenue, up 81.6% from a year ago. For Q2, SCTY provided EPS guidance of ($2.80)-($2.70) versus consensus of ($2.23) per share. The company also issued revenue projection of $135-$143 million, compared to the consensus revenue estimate of $152.39 million.

Profitability-wise, SCTY has a t-12 profit and operating margin of (14.6%) and (162.1%), respectively. The $2.21 billion market cap company reported $393.86 million in cash vs. $2.86 billion in debt in its most recent quarter.

SCTY currently prints a one year loss of about 64.14% and a year-to-date loss of around 57.19%.

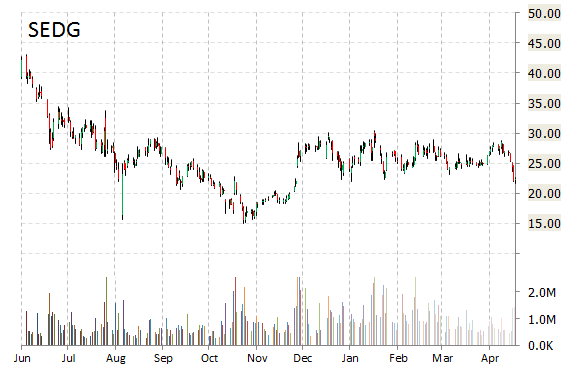

SolarEdge Technologies, Inc. (SEDG) reported Q316 non-GAAP EPS of $0.51 after the closing bell Monday, compared to the consensus estimate of $0.41. Revenues increased 44.9% from last year to $125.2 million. Analysts expected revenues of $123.23 million. The company guided Q2 revenues of $125-134 million, as compared to analysts’ expectations of $134.18 million.

On valuation measures, SolarEdge Technologies shares, which currently have an average 3-month trading volume of 765,127.00 shares, trade at a trailing-12 P/E of 19.06, a forward P/E of 9.65 and a P/E to growth ratio of 0.26. The median Wall Street price target on the name is $36.00 with a high target of $42.00. Currently ticker boasts 11 ‘Buy’ endorsements, compared to 1 ‘Holds’ and no ‘Sell’.

The stock is currently down $1.70 to $20.89 on 1.61 million shares.

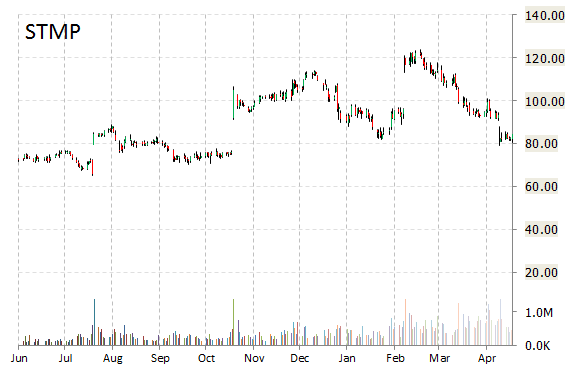

Stamps.com Inc. (STMP) rallied $15.46 to $103.80 in after-hours trading after it reported fiscal results for the first quarter.

In its quarterly report, the provider of Internet-based postage solutions said it earned $1.72 per share, well above the $1.05 per share analysts were expecting. Revenue rose 85.7% to $81.8 million, above views for $68.5 million. The company guided FY16 revenues of $310-330 million, as compared to analysts’ expectations of $302.73 million. The management also gave its bottom line range of $6.00-$6.50 per share, against projections of $5.28 per share.

The company’s current year and next year EPS growth estimates stand at 19.20% and 14.60% compared to the industry growth rates of 9.80% and 19.10%, respectively. STMP has a t-12 price/sales ratio of 6.56. EPS for the same period registers at (0.26). STMP’s shares have declined (12.86%) in the last 4 weeks and (3.99%) in the past three months. Over the past 5 trading sessions the stock has gained 2.44%.

Leave a Reply